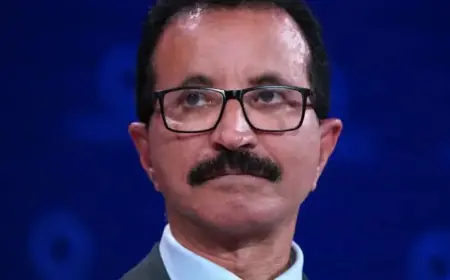

Toronto Accountant Accused of Stealing Millions in a Ponzi Scheme

In a shocking turn of events, Toronto accountant John Rosenthal faces serious allegations of orchestrating a Ponzi scheme, reportedly defaulting on millions owed to his clients. Once regarded as a trusted professional and close friend by many, Rosenthal’s downfall has left his clients and investors bewildered.

Background of John Rosenthal

John Rosenthal, 75, began his career as a licensed accountant in 1973. He joined a reputable Toronto firm, becoming a partner by 1981. In the late 1980s, he co-founded RZN, LLP with Mark Zaretsky. Their clientele included various law firms, financiers, and high-profile business owners, establishing Rosenthal as a formidable player in Toronto’s accounting scene.

Allegations and Consequences

Rosenthal’s professional life drastically changed when the Chartered Professional Accountants of Ontario revoked his license due to alleged misconduct. He now faces multiple lawsuits, with claims amounting to millions. Meanwhile, his former partner Zaretsky has declared bankruptcy owing $17 million, while Rosenthal has yet to file for bankruptcy but continues to reside in a high-end Toronto neighborhood.

Investors Left in the Lurch

Among Rosenthal’s invested clients is Peter Israel, a Toronto lawyer, who along with his wife, invested $300,000 into what they believed were secure real estate deals. Other clients, including businessman Michael Levine and entrepreneur Robert Sidi, similarly invested significant sums, all drawn by Rosenthal’s charm and perceived expertise.

Investment Schemes and Trust

- Peter Israel: Invested $300,000; trusted Rosenthal deeply.

- Michael Levine: Trusted his “best friend” with $325,000.

- Robert Sidi: Invested $250,000 based on friendship and trust.

- Gilbert Sharpe: Gave $40,000, depending on verbal agreements.

Many of these investments were made with minimal documentation. Clients often received promissory notes and vague verbal assurances about the whereabouts and legitimacy of the purported real estate assets.

Rosenthal’s Lifestyle and Charisma

Clients reminisced about Rosenthal’s charismatic personality, recalling their friendships with him intertwined with financial transactions. He was known to go above and beyond to aid his clients, creating bonds that blurred lines between professional advice and personal friendship. However, this personal rapport has led many to overlook thorough due diligence, contributing to their current predicament.

The Fallout

As payments from Rosenthal abruptly stopped in June, many investors struggled to reach him, realizing exponential losses. The abrupt end of payments has left clients grappling with the severity of their financial situations and the betrayal from a person they once considered a friend.

Conclusion

John Rosenthal’s case serves as a stark reminder of the potential risks in financial investments. As more details emerge from the investigations, the fallout will likely impact not only Rosenthal but also the broader accounting profession in Toronto. Investors must now reassess their vetting processes and the importance of documenting agreements in any investment journey.

For future updates and detailed reports, stay tuned to Filmogaz.com.