Anthropic Valued at $380B, Intensifies Rivalry with OpenAI

Anthropic, an emerging leader in artificial intelligence, has recently reached a significant milestone with its valuation now standing at $380 billion. This considerable increase positions the company as a key player alongside OpenAI and SpaceX, making it one of the world’s most valuable startups.

Funding Success and Future Plans

This impressive valuation results from Anthropic’s latest funding round, where it secured $30 billion. The funding was primarily spearheaded by Singapore’s sovereign wealth fund, GIC, and the U.S.-based investment firm, Coatue. Numerous other prominent investors also contributed to this substantial funding.

A notable part of this investment includes a portion of the $15 billion previously pledged by Nvidia and Microsoft in November. That investment links to a long-term agreement in which Anthropic is set to purchase around $30 billion in computing capacity from Microsoft, vital for developing advanced AI systems like its chatbot, Claude.

Key Partnerships

- Backed by major cloud providers: Amazon and Google.

- Collaborative investment from Nvidia and Microsoft.

Market Position and Profitability

Despite being unprofitable at this stage, Anthropic projects it will achieve sales of $14 billion over the next year. This projection marks a stark contrast to its initial revenue generation, which only began less than three years ago. Anthropic is currently ranked third among the most valuable private companies, trailing OpenAI, valued at $500 billion, and SpaceX.

Innovation in AI Products

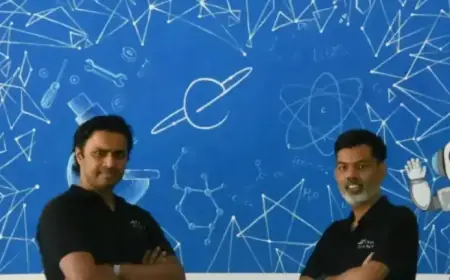

Founded in 2021 by former OpenAI employees, Anthropic has focused on creating enterprise-grade AI products. Its CEO, Dario Amodei, emphasized the importance of developing safe and reliable artificial general intelligence. Claude, Anthropic’s AI product, is designed specifically to assist in workplace tasks such as software engineering.

Regulatory Influence and Future IPOs

In a move to shape the future of AI regulation, Anthropic recently launched a bipartisan organization with an investment of $20 million. As companies like Anthropic and OpenAI eye potential initial public offerings (IPOs), the market eagerly anticipates the outcomes. The opportunity to go public could significantly enhance their financial resources while also raising the stakes amidst increased scrutiny from investors.

Experts from Renaissance Capital note that whichever company successfully executes an IPO first will likely attract substantial attention and financial backing, providing an opportunity for substantial capital growth.

The Competitive Landscape

Both Anthropic and OpenAI have established themselves as crucial players in the AI industry, each with unique strategies for monetization. While OpenAI explores various revenue models, including digital advertising, Anthropic’s approach remains focused on specialized products designed for professional settings.

With the AI market rapidly evolving, both companies are set to face challenges in public markets, including heightened scrutiny of their business models. As they navigate this landscape, the expectation of significant innovations and regulatory developments continues to grow.