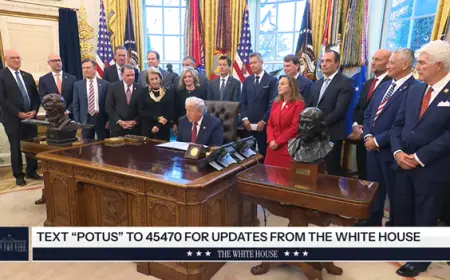

Congress Exercises Rare Authority to Block D.C. Tax Policy

In an unusual move, Congress has exercised its authority to prevent Washington D.C. from rejecting federal tax cuts established during President Donald Trump’s administration. This decision has sparked a mix of celebrations and concerns among various stakeholders.

Congress Blocks D.C. Tax Policy

The recent Congressional vote aims to maintain the federal tax policies that are expected to increase disposable income for residents. Supporters, mainly Republicans, argue that the tax cuts will benefit Washingtonians by allowing them to keep more of their earnings.

Concerns Raised by City Officials

However, local officials have voiced significant concerns about the implications of this decision. They warn that this measure could lead to complications during tax season as the city adjusts to the enforced tax policy. Additionally, the anticipated revenue losses could reach hundreds of millions of dollars.

- Celebrations: Republicans view the decision as favorable for residents’ finances.

- Concerns: City officials fear complications and revenue losses.

- Impact: Possible hundreds of millions in lost revenue for the city.

This rare exercise of authority by Congress reflects ongoing tensions between local governance and federal regulations. As tax season approaches, Washington D.C. prepares for a challenging period that may affect its budget and financial planning.