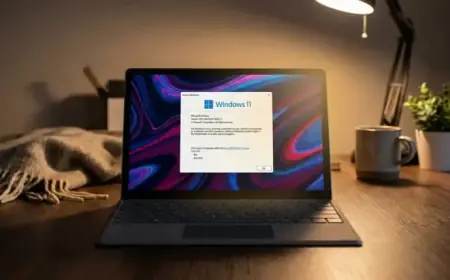

CSCO stock slips as Cisco tops Q2 estimates and raises outlook

Cisco Systems beat Wall Street expectations for fiscal second-quarter earnings and revenue and set an April-quarter revenue outlook above consensus, yet CSCO stock fell after the release. The quarter, which ended January 31, included contributions from recently acquired software maker Splunk, highlighting Cisco’s ongoing shift toward a larger software and security footprint.

Headline results: beats on the top and bottom line

The networking giant cleared estimates on both earnings and revenue for the fiscal second quarter, posting growth that reflected demand resilience across key customer categories and the first full-period contribution from Splunk. The performance extended Cisco’s push to blend hardware, software, and security, with management emphasizing the company’s evolving mix of recurring and subscription-driven sales.

Investors were primed for a beat heading into the print, with a heavy focus on the extent to which software strength and cost controls could offset uneven enterprise spending and elongated deal cycles that have characterized the broader IT landscape over the past year. The results offered evidence of operational discipline and execution across a broad portfolio while adding the scale and analytics depth of Splunk.

Guidance: April-quarter outlook lands above views

For the April quarter, Cisco outlined revenue guidance that came in above consensus expectations. The outlook suggested management’s confidence that order activity and product deliveries can support a healthier near-term trajectory than the market had penciled in. The frame for the quarter included ongoing integration of Splunk and the benefits of cross-selling security and observability software into Cisco’s global customer base.

While precise ranges were not the focal point for traders immediately after the release, the direction of the guidance—above views—served as a constructive data point. Investors will parse the implied pace of product shipments, subscription renewals, and any commentary on public sector and service provider spending patterns as the quarter unfolds.

Market reaction: why the dip in CSCO stock?

Despite the headline beats and a better-than-expected April outlook, CSCO stock moved lower following the announcement. Several cross-currents can weigh on shares in this setup: expectations had drifted higher into the print; some holders may have used the event to lock in gains; and the market often scrutinizes underlying order trends and visibility more intensely than the headline numbers alone. Even modest caution around deal timing, backlog normalization, or macro budget planning can overshadow a clean beat in the short term.

Reaction days like this are not uncommon for established technology leaders that must now prove consistency across several quarters, especially after a period of mixed enterprise IT spending. For near-term direction, the next catalysts typically include management’s color on demand linearity through the current quarter and any updates on margin progression as the software mix increases.

Splunk integration moves to center stage

This quarter marks a key step in folding Splunk’s security and observability platform into Cisco’s portfolio. Investors are watching for tangible signs that the combined company can accelerate cross-sell opportunities, deepen customer stickiness, and expand recurring revenue. Integration milestones—go-to-market alignment, platform interoperability, and unified data analytics—will be central to the investment case over the next few quarters.

Cost synergies and operating leverage also enter the conversation as Cisco harmonizes product roadmaps and support organizations. Success on these fronts could strengthen the margin profile over time, while broadening the total addressable market beyond traditional networking into higher-growth software categories.

What to watch next

With the beat-and-raise now in the tape, attention shifts to execution in the April quarter. Key watch items include:

- Order momentum and billings trends as a read-through on customer budgets in early 2026.

- Software and subscription growth as Splunk is integrated and cross-selling ramps.

- Gross margin trajectory, reflecting mix, pricing, and supply-chain normalization.

- Any updated commentary on demand from cloud, service provider, and public sector channels.

For long-term holders, the evolving revenue mix and expanded software platform could underpin a more durable growth profile. For traders, the near-term setup will hinge on whether early-quarter demand checks corroborate the above-consensus outlook and whether management can demonstrate steady progress on integration milestones.

Bottom line: Cisco cleared the bar on results and outlook, but the stock’s drop underscores a market demanding sustained proof that order trends, margins, and software synergy capture can outpace already-elevated expectations.