Jobs Report Today: January Payrolls Rise by 130,000 as Unemployment Holds at 4.3 Percent and Big Revisions Reframe 2025

The jobs report today delivered a stronger-than-expected start to 2026 on the surface, with employers adding 130,000 jobs in January and the unemployment rate essentially steady at 4.3 percent. But the bigger story may be the reset happening underneath: major benchmark revisions and model changes are reshaping how investors, businesses, and policymakers read the labor market after a weak 2025.

The report, released at 8:30 a.m. ET on Wednesday, February 11, 2026, paints a picture of an economy still creating jobs, but in a narrower set of sectors, with participation and broader labor-force metrics largely flat.

Jobs report today: the headline numbers

January nonfarm payrolls increased by 130,000. The unemployment rate was 4.3 percent, with 7.4 million people unemployed.

Two additional signals stood out in the household data. The labor force participation rate was 62.5 percent and the employment-population ratio was 59.8 percent, both little changed. Long-term unemployment remained elevated: 1.8 million people were out of work for 27 weeks or more, representing 25 percent of the unemployed.

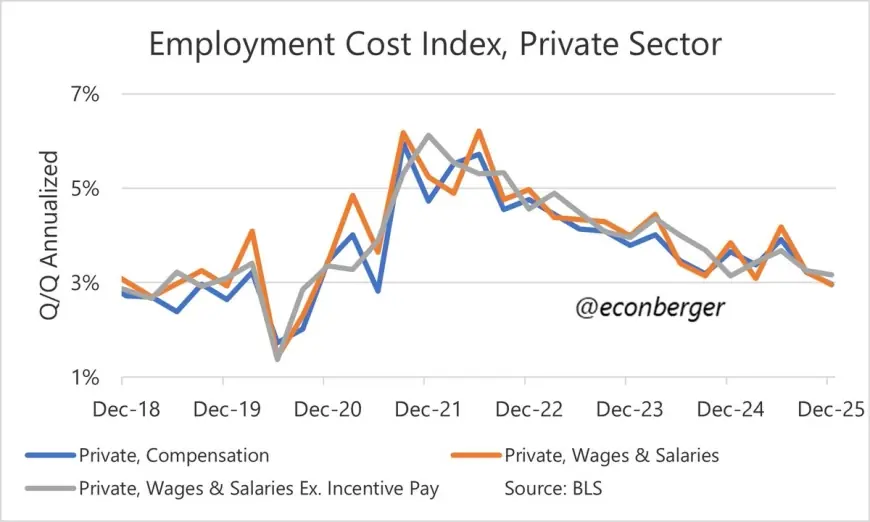

A mixed detail for worker leverage: average hourly earnings for private payrolls rose 0.4 percent in January to $37.17, up 3.7 percent over the past year. The average private-sector workweek ticked up to 34.3 hours.

Where the jobs were: health care and services did the heavy lifting

Job gains were concentrated in a familiar cluster.

Health care added 82,000 jobs, led by ambulatory services, hospitals, and nursing and residential care. Social assistance rose by 42,000, largely in individual and family services. Construction added 33,000, with nonresidential specialty trade contractors driving most of the increase.

On the downside, federal government employment fell by 34,000. Financial activities declined by 22,000, with insurance-related categories a notable drag. Many other major industries showed little change, which reinforces the idea that job creation is present but not broadly distributed.

The revision shock: why this jobs report hit harder than usual

This release landed with an unusually large credibility reset because the annual benchmark process revised prior levels lower. On a not seasonally adjusted basis, the total nonfarm employment level for March 2025 was revised down by 862,000 jobs. On the seasonally adjusted side, the change in total nonfarm employment for 2025 was revised down sharply, from 584,000 to 181,000.

That matters because it reframes the recent past. A weaker 2025 baseline can change how analysts interpret a 130,000 gain in January: it can look less like a re-acceleration and more like modest stabilization after a sluggish year.

Separately, the prior two months were revised down modestly. November payroll gains were cut to 41,000 and December to 48,000, a combined reduction of 17,000.

Behind the headline: incentives, pressure points, and what’s driving the labor market now

Three forces are shaping the current jobs narrative.

First, the economy’s “essential services engine” is still running. Health care and social assistance continue to absorb labor, supported by demographics and steady demand. That provides resilience even when more cyclical sectors hesitate.

Second, policy and budget dynamics are showing up directly in payrolls. The federal employment drop is not just a statistic; it affects local economies tied to government spending and can ripple into contractors and regional service businesses.

Third, the revisions change incentives for everyone watching the data. Policymakers get a different read on slack, investors recalibrate rate expectations, and businesses reassess how tight hiring conditions really are. When the past is revised, confidence in forward-looking signals tends to dip, and markets often demand “proof” over several months rather than reacting to a single print.

What we still don’t know

The report leaves open several key questions that will define the next leg of the story:

-

Whether job growth broadens beyond health care, social assistance, and construction

-

Whether wage growth stays firm without reigniting inflation concerns

-

Whether labor-force participation can rise meaningfully, which would ease hiring pressures without requiring a slowdown

-

Whether the revisions signal deeper measurement challenges or a one-time recalibration that clears the decks

What happens next: realistic scenarios and triggers

-

Steady cooling with stable unemployment

Trigger: payroll gains continue at a moderate pace while participation stays flat. -

Broader rebound beyond services

Trigger: sustained gains reappear in cyclicals like manufacturing, logistics, and business services. -

Wage growth holds up and complicates rate decisions

Trigger: earnings growth remains near current levels while inflation progress stalls. -

Growth scare re-emerges

Trigger: payroll gains fade and part-time for economic reasons rises again after January’s drop to 4.9 million. -

Data confidence becomes the central debate

Trigger: additional benchmark-related adjustments or survey response issues amplify uncertainty.

The next Employment Situation report is scheduled for Friday, March 6, 2026, at 8:30 a.m. ET.