RBA Deputy Governor Cites ‘Three Key Factors’ for Rate Increase

The Reserve Bank of Australia’s (RBA) Deputy Governor, Andrew Hauser, defended the bank’s stance on government spending during recent discussions about inflation. Speaking in Sydney, Hauser emphasized that it is not the role of unelected officials to critique the expenditure choices of an elected government. His remarks highlighted the delicate balance that central bankers must maintain concerning public policy.

Central Bank’s Role in Public Policy

Hauser addressed criticisms aimed at the RBA for not being vocal about government spending. He reiterated that demand from both public and private sectors should be viewed equally in terms of inflation impact. “The government determines the composition of total demand,” he stated, emphasizing the importance of Australia’s strong electoral system.

Responses to Calls for Criticism

Mr. Hauser expressed skepticism regarding the need for the RBA to publicly critique government fiscal policies. He posed a question: What if the RBA took an opposing stance to the government? His comments came shortly after RBA Governor Michele Bullock also avoided placing blame on the Albanese government’s spending for rising inflation.

Factors Influencing Inflation

Governor Bullock outlined several contributors to recent inflation increases, citing low unemployment, rising real incomes, tax cuts, and government expenditure. She noted that while government spending may have played a role, it was far from being the sole factor influencing inflation dynamics.

Hauser reiterated that the RBA’s strategy, which included not raising interest rates significantly during the COVID-19 inflation period, resulted in an economy that is now highly sensitive to demand shocks.

Australia’s Economic Balance

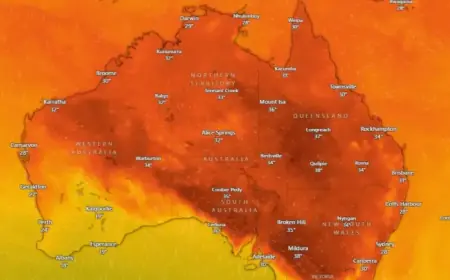

Hauser also referred to Australia’s economy as finely balanced, making it more vulnerable to demand fluctuations compared to other countries like New Zealand and Canada, which are not as close to economic equilibrium. He indicated that Australia has successfully maintained low unemployment rates post-pandemic, but this comes with risks of inflation responding to small demand shocks.

Impact of Global and Domestic Changes

Hauser noted that the RBA raised interest rates in February due to three key factors that had shifted. The first was the unexpected strong global economic performance, particularly in tech and AI sectors. This robust growth was highlighted by export data from Taiwan.

- Global Economic Landscape: Economic predictions at the start of 2026 were notably conservative compared to the current strong global indicators.

- Policy Stance Adjustments: The RBA’s monetary policy stance included aspects like low credit growth and low-risk premiums, contributing to increased demand.

- Demand vs. Supply Surge: A surge in private demand relative to supply changed economic dynamics, aligning with previous model predictions but occurring later than expected.

Hauser acknowledged the importance of economic models in guiding policy decisions, admitting past errors in timing predictions while asserting that they must not be ignored entirely. As Australia navigates its current economic challenges, the impact of these key factors will be closely monitored by the RBA and other economic stakeholders.