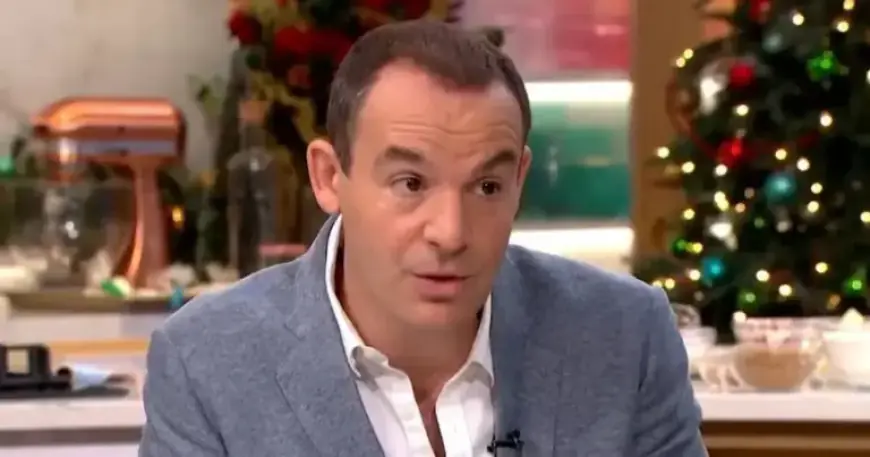

Martin Lewis Advises Seniors to Follow Crucial Spending Rule for Improved Life

Financial expert Martin Lewis has recently emphasized a crucial spending philosophy for seniors planning their retirement. He encourages individuals to enjoy their hard-earned savings while being mindful of financial responsibilities.

Emphasizing the Importance of Enjoyment in Retirement Finances

During a recent episode of his BBC podcast, Lewis shared insights and advice gathered from his audience. A notable point came from Chris, a 62-year-old who opted for early retirement. Chris stressed the importance of indulging in life now rather than waiting for a later time when health may hinder such experiences.

Chris’s Perspective on Spending

- Chris advises enjoying retirement savings now.

- He cautions against feelings of guilt for spending money meant for enjoyment.

He articulated his philosophy, stating, “My policy is to enjoy now the money I’ve saved, as in another 15 or 20 years, I might not want to enjoy the things or visit the places I want to now.”

Martin Lewis’s Endorsement of Practical Spending

Martin Lewis resonated with Chris’s viewpoint. He noted, “Money is about utility and happiness.” His advice includes planning wisely while ensuring that spending aligns with personal values and enjoyment. He emphasized the need for individuals to be aware of their financial decisions, avoiding waste on items that do not bring happiness or value.

Understanding Retirement Financial Planning

Seniors in their early 60s should be mindful of their state pension eligibility, particularly with changes on the horizon. The state pension age is currently 66 but is scheduled to gradually rise to 67 by April 2028.

State Pension and National Insurance Contributions

- 35 years of National Insurance contributions needed for full state pension.

- Current state pension rate: £230.25 per week; set to rise to £241.30 from April 2026.

- State pension payments will see a 4.8% increase under the triple lock policy.

Individuals can check their state pension predictions using tools on the Government’s website. With at least 10 years of contributions required for any pension benefits, it’s crucial for seniors to review their National Insurance records. They may be able to fill gaps in their contributions by voluntarily purchasing them for up to six previous tax years, although this does not guarantee increased benefits.

Additional Benefits for Seniors

As retirement approaches, there are various benefits seniors should consider. For those on low income, Pension Credit provides an average of £4,300 annually in extra support. This benefit not only enhances weekly income but also opens doors to further government assistance.

- Attendance Allowance is available for individuals needing support due to a disability.

- Additional benefits include Winter Fuel Payments and Cold Weather Payments.

For seniors looking to make the most of their retirement finances, following Martin Lewis’s advice can lead to improved financial health and a more fulfilling life.