USD Faces Rising Challenges Amidst Strengthening Headwinds

The U.S. dollar is beginning the week under pressure as it faces various market dynamics. Risk assets are gaining traction, especially in technology sectors, where the Nasdaq experienced a 2% uptick last week. Global equity markets are performing positively, noted particularly in Japan’s indices, following the Liberal Democratic Party’s significant electoral success.

Japanese Market Response

The Japanese Nikkei index surged more than 5% after the LDP’s landslide victory. Initially, expectations were that this success would lead to a substantial outflow from Japanese government bonds (JGBs) and the yen. Analysts anticipated increased fiscal spending without sufficient funding, which would necessitate intervention from the Bank of Japan (BoJ).

- The LDP claims that temporary food tax cuts will not lead to new debt issuance.

- This has calmed fears regarding JGB market instability.

- The narrative may shift from ‘Sell Japan’ to ‘Buy Japan’ as the government seeks to stimulate growth.

Market responses indicate that investors are pricing in a higher interest rate forecast from the BoJ. Any intervention from the bank is expected to occur if the USD/JPY exceeds the 158 mark.

U.S. Economic Influences on the Dollar

Conversely, domestic economic indicators pose challenges for the dollar. Recent labor market statistics have fallen short of expectations, prompting concerns about the Federal Reserve’s assessment of job growth. The upcoming January Non-Farm Payrolls (NFP) report, scheduled for release on Wednesday, is crucial.

- Market consensus anticipates an increase of around 70,000 jobs.

- Any significant deviation from this could have adverse effects on the dollar.

This week’s data releases will also include December retail sales and January Consumer Price Index (CPI) figures, both vital in influencing dollar performance. Weakness in these indicators could further contribute to dollar depreciation.

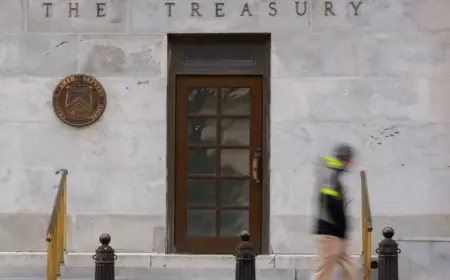

Geopolitical Factors and Market Sentiment

Recent developments in China have also impacted market dynamics. Reports indicate that Chinese regulators advised private banks to limit their investments in U.S. Treasuries to mitigate concentration risks. As of last November, China and Hong Kong held a combined $938 billion in U.S. debt.

- This recommendation comes at a pivotal moment for dollar stability.

- Growing global diversification trends could intensify scrutiny on dollar holdings.

As the week progresses, unless there’s a significant shift in risk appetite, the dollar is likely to continue facing headwinds. The DXY index stalled at 98.00, with initial targets potentially falling between 97.00 and 97.05.

In conclusion, the U.S. dollar is navigating complex challenges. Domestic economic data and international geopolitical factors create uncertainty that may lead to further weakening.