Trump Family’s Crypto Investments Suffer Amid Industry Downturn

The recent downturn in the cryptocurrency market has significantly impacted various investments, including those associated with the Trump family. The overall market has lost approximately $1 trillion in value over the past three months, affecting numerous crypto ventures linked to President Donald Trump’s family.

Key Investments and Market Performance

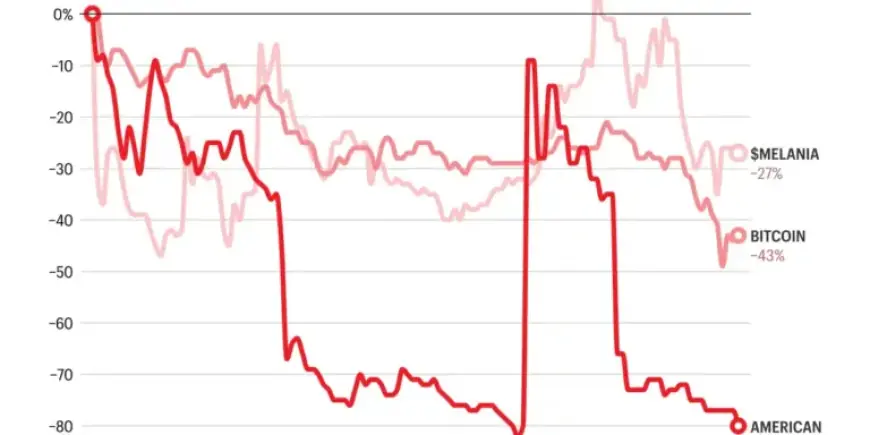

While the Trump family’s crypto portfolio faces a steep decline, some assets have fared worse than others. The worst performer is the stock of American Bitcoin, a company supported by Eric and Donald Trump Jr. Since the market experienced what is known as the “flash crash” on October 10, its value has plummeted by about 80%. This decline has brought its market capitalization down to just over $1 billion from a high of nearly $8.5 billion when it went public in September.

Performance of Crypto Assets

In contrast, the best-performing asset in the Trump family’s crypto portfolio is Melania Trump’s memecoin, $MELANIA. Despite suffering a decline of 27%, it showed some resilience before the release of Melania Trump’s documentary in January. Nevertheless, it remains down more than 98% since its launch just before President Trump’s inauguration.

The Trump family’s investments mirror the broader volatility seen in the cryptocurrency market. Over the past year, a substantial portion of the family’s wealth has become linked to this industry, prompting questions about the sustainability of their crypto portfolio.

Valuation of the Trump Family’s Crypto Holdings

The Trump family’s cryptocurrency holdings were estimated at about $3 billion as of early January. This figure includes several key components:

- American Bitcoin

- ALT5 Sigma, a crypto hoarding company

- Trump Media & Technology Group, which has invested nearly $1 billion in Bitcoin

- Three specific cryptocurrencies: Melania’s memecoin, another associated with President Trump, and one launched by World Liberty Financial

World Liberty Financial stands out as the family’s most lucrative venture in the crypto space. According to a recent Wall Street Journal analysis, the Trumps have realized at least $1.2 billion in cash from this investment over the past 16 months.

Conclusion

The recent cryptocurrency crash raises concerns about the resilience of the Trump family’s investments in the digital asset sphere. Despite their financial successes, the fluctuation in value reveals the inherent risks of the cryptocurrency market, which has historically been unpredictable.