NatWest Secures £2.7 Billion Acquisition of Evelyn Partners

NatWest has made headlines with its decision to acquire Evelyn Partners for £2.7 billion. This strategic move marks a significant shift in the bank’s financial strategy, leading to the cancellation of planned share buybacks worth around £2 billion over the next 18 months.

Details of the Acquisition

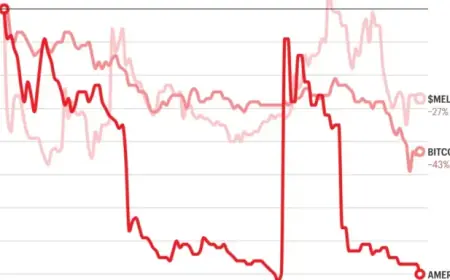

On the announcement of the acquisition, NatWest’s shares fell by 6%, resulting in a loss of over £3 billion in market value. The bank has committed to a single £750 million buyback, halting further repurchases until interim results are out in the summer of 2027. Analysts had previously estimated total buybacks of up to £2.8 billion during this period.

Impact on Wealth Management

- The acquisition will merge NatWest’s existing Coutts business with Evelyn Partners.

- This creates the largest private banking and wealth management entity in the UK.

- The combined assets under management will total approximately £127 billion.

Despite potential job losses, NatWest expects to achieve annual run-rate synergies of around £100 million. The Evelyn name will continue to be used initially, impacting around 150,000 clients in the UK.

Context of the Acquisition

Edinburgh-based NatWest outbid other financial institutions, including Barclays and the Royal Bank of Canada, to finalize the deal. This acquisition aligns with a broader trend among British banks, like HSBC and Lloyds, which are increasingly focusing on wealth management to counterbalance declining interest income from central bank rate reductions.

Leadership Perspectives

Paul Thwaite, NatWest’s CEO, emphasized the need to enhance customer investment opportunities through expanded services. He stated, “The benefits of saving and investing are increasingly part of the national conversation.”

This deal represents NatWest’s largest corporate acquisition since its controversial joint purchase of ABN Amro in 2008, which led to a massive taxpayer bailout.

Evelyn Partners Overview

- Evelyn Partners was previously owned by private equity firms Permira and Warburg Pincus.

- The firm was created in 2020 from the merger of Tilney and Smith & Williamson.

- It currently manages around £63 billion in client assets and employed about 2,400 people at the end of 2024.

Paul Geddes has led Evelyn Partners since 2023, following a notable career, including key positions at Royal Bank of Scotland, now known as NatWest.

Market Implications

Analysts are divided on the acquisition’s impact. Some view it as a transformative yet strategic transaction that could bridge gaps in NatWest’s affluent wealth offerings. Others express caution, highlighting that the success of the deal heavily depends on delivering expected synergies.

The acquisition will be funded through NatWest’s existing resources and may reduce the bank’s core equity tier 1 ratio by approximately 130 basis points. The ongoing shifts in the wealth management market have seen significant deals, including Royal Bank of Canada’s purchase of Brewin Dolphin for £1.6 billion and Raymond James’ acquisition of Charles Stanley for £279 million.

As NatWest prepares to release its full-year results, the financial sector will closely monitor the implications of this hefty acquisition on the bank’s future strategy and stability.