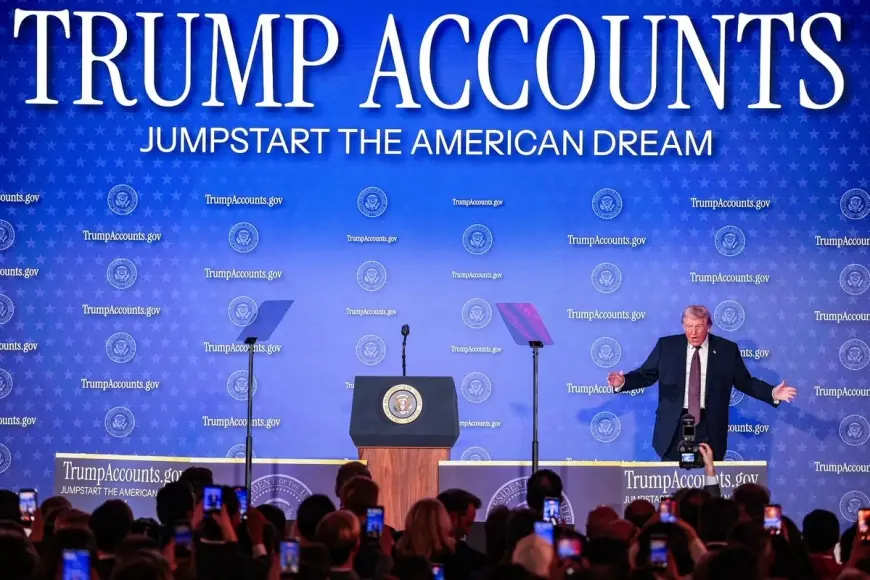

“Trump Accounts” for kids: what the Invest America program is and how it works

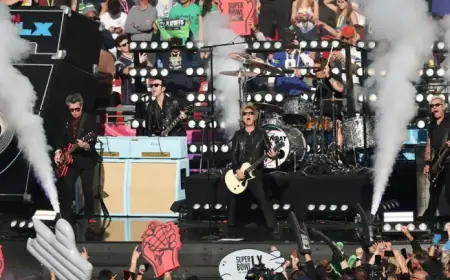

A new federal savings initiative branded as “Trump Accounts” is moving from policy idea to practical rollout in 2026, promising $1,000 in starter money for eligible newborns and a long-term, market-based account designed to grow until adulthood. The program—also promoted under the “Invest America” name—has surged into mainstream attention after a big national advertising push tied to Super Bowl weekend, with banks, employers, and local partners announcing matching contributions and outreach plans.

For parents and relatives, the immediate question is straightforward: who qualifies, when can you open one, and how soon can money actually go in?

What a “Trump Account” is in plain terms

A Trump Account is a tax-advantaged investment account for children built around the idea that starting early—at birth—gives compounding time to work. The federal government provides a $1,000 seed contribution for eligible children in a limited pilot window, and families can add their own contributions over time. The funds are intended to be invested in a broad, low-cost market index approach rather than sitting as cash.

The account is in the child’s name, with an adult serving as custodian until the child reaches adulthood.

Who is eligible for the $1,000 seed deposit

The eligibility rules are designed to be simple, but they are strict:

-

The child must be a U.S. citizen with a valid Social Security number.

-

The child must be born between January 1, 2025, and December 31, 2028 to receive the federal $1,000 seed contribution.

Families with children outside that birth window may still be able to open an account (depending on final program rules and participating providers), but the federal seed money is tied to that 2025–2028 cohort.

How to open one and when contributions begin

The rollout is happening in phases. Families can begin the process during the current tax season using a designated tax form and election, while broader online enrollment is expected later in 2026. The program’s funding and contribution mechanics are also staggered: the federal seed contribution is connected to the enrollment/tax election process, while private contributions are expected to begin in early July 2026.

That timing matters for expectations. Many families can “get the account started” earlier, but they may not be able to actively fund it until the summer contribution window opens.

Key rules, limits, and who can contribute

The program blends public seed money with private saving. Contributions can come from parents, relatives, friends, employers, and even certain public or philanthropic partners. The most important practical constraint is the annual cap on private additions.

| Feature | What it means |

|---|---|

| Federal seed money | $1,000 for eligible children (births in 2025–2028) |

| Private contribution limit | Up to $5,000 per child per year (limit applies to private funds) |

| Employer contributions | Up to $2,500 per year may be contributed through an employer program and can be structured to avoid counting as the worker’s taxable income |

| Ownership and control | Account is in the child’s name; a custodian controls it until age 18 |

| Access age | Funds generally become accessible when the child turns 18 (rules for use and withdrawals can vary by final guidance) |

Why companies and cities are getting involved

A notable feature of the early rollout is how quickly private institutions have tried to “wrap” the federal seed money with matches. A major bank recently announced it will match the government’s $1,000 starter contribution for eligible children, joining other large financial institutions that have signaled similar programs.

Some local leaders are also treating Trump Accounts as an anti-poverty tool—especially in high-cost cities—by funding outreach, enrollment support, or supplemental contributions aimed at low-income families. The pitch is that the hardest part isn’t the investment math; it’s making sure eligible families actually enroll and stay engaged long enough for the balance to grow.

The debate: wealth-building tool or risky access at 18?

Supporters frame the accounts as a national wealth-building on-ramp that encourages financial literacy and long-term investing from birth. They point to the basic arithmetic of compounding: a modest seed in an index fund can become meaningful over 18 years, especially if families or employers add even small amounts consistently.

Critics raise two concerns. First, they question whether the program will widen gaps if higher-income families contribute more and capture more growth. Second, they worry about unrestricted access at age 18, arguing that a large balance arriving all at once could be misused without guardrails.

The next practical milestones will be enrollment scale during the 2026 filing season and how many matches and supplemental programs materialize once contributions open in July.

Sources consulted: Reuters; Associated Press; Internal Revenue Service; MarketWatch