Stock Market Crash Looms: My Strategic Response

The stock market is always a topic of concern among investors, particularly when a downturn seems imminent. Recent events suggest that we may be approaching another crash. However, this situation could also present opportunities.

Stock Market Dynamics and AI Challenges

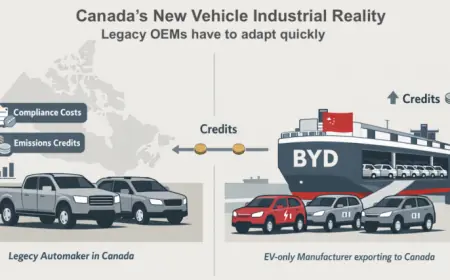

Several factors contribute to fluctuating share prices, but the primary catalyst right now is artificial intelligence (AI). Major companies like Meta, Microsoft, Alphabet, and Amazon have unveiled increased capital expenditure plans for 2026, indicating a robust investment in AI technologies. However, skepticism surrounds the actual returns on these investments, leading to fears of an AI bubble.

Both the US and UK economies depend on stable employment to foster consumer spending. If AI adoption accelerates, it could endanger many jobs, potentially leading to reduced consumer spending and further jeopardizing the stock market’s health.

Lessons from History

Historical patterns reinforce the idea that investors who maintain holdings in high-quality companies tend to fare well over the long haul. For instance, the “Nifty Fifty,” a group of US stocks perceived as unbeatable, experienced significant declines during the 1973-74 stock market crash. Some of these stocks never returned to form; however, those that did far exceeded their previous values. A $1,000 investment in Philip Morris in 1972 is estimated to be worth approximately $43 million today.

Strategic Response to Market Fluctuations

The lessons from the Nifty Fifty are invaluable. I am focused on building a portfolio composed of high-quality shares that I plan to hold regardless of market conditions. One stock I have recently acquired is Brown & Brown (NYSE:BRO), an insurance brokerage geared towards businesses that are too large for local brokers yet too small for larger firms. Its significant scale provides a competitive edge by allowing better rates from insurance carriers.

Investment Considerations

Investing always entails risks, even in reputable companies. The Nifty Fifty exemplifies how even strong enterprises can struggle. My main concern with Brown & Brown is the potential for business consolidations or closures, which could be heightened by AI automation. While I cannot ensure all my investments will succeed, I am committed to creating a diversified portfolio that increases my chances for positive returns.

Conclusion

As we ponder a possible stock market crash, it is crucial to approach investments strategically. Understanding the implications of AI and historic trends can guide effective decision-making in uncertain times.