Understanding Japan’s Economy on Election Day: Key Insights

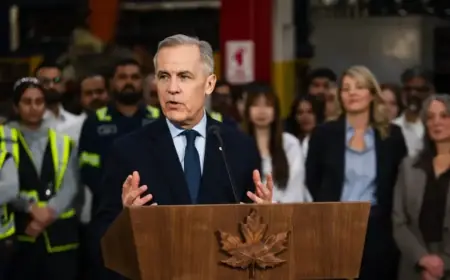

In her initial days in office, Japan’s Prime Minister Sanae Takaichi has focused on transforming the nation’s economy through expansive fiscal measures. These proposals, while aimed at stimulating growth, have raised concerns over Japan’s already high debt levels.

Key Economic Initiatives

Takaichi advocates for aggressive government spending to combat a long-standing deflationary trend. Last year, she passed a substantial supplementary budget to foster financial momentum. Her administration is also advancing plans to boost military expenditure and push for significant state-led investments in high-tech sectors, such as artificial intelligence and semiconductor manufacturing.

Election as a Referendum on Economic Policy

A snap election scheduled for Sunday will serve as an important gauge of public sentiment towards Takaichi’s economic strategies. Voters are grappling with critical questions about whether her expansionary fiscal policies have jeopardized Japan’s financial stability.

Tax Proposals and Market Reactions

Recently, Takaichi proposed the suspension of certain consumption taxes, a move anticipated to cost Japan’s treasury more than $30 billion yearly, according to the Finance Ministry. This plan has triggered a rise in government bond yields, prompting investor concerns regarding the feasibility of funding such initiatives.

Stock Market Resilience

Despite the volatility in the bond market, Japan’s stock market has performed robustly. Major indices, including the Nikkei 225, have reached record highs under Takaichi’s leadership. This growth can be attributed to a weaker yen and strong corporate earnings.

Inflation Trends and Economic Outlook

In recent years, the chronic deflation that characterized Japan’s economy is beginning to fade. Although households face rising costs for essential goods like energy and food, there are signs that inflation is moderating. Economists predict that consumer prices in February could drop to about 1 percent year-on-year, the lowest figure in nearly four years.

Impacts on Wages and Household Finances

With inflation easing, wage growth may start to outpace price increases, providing a much-needed boost to household finances. Bruce Kirk, chief Japan equity strategist at Goldman Sachs Research, noted that Japan might finally be emerging from its long-standing deflationary cycle.

Challenges from International Relations

However, Takaichi’s administration faces significant external challenges. Diplomatic tensions with China have led to economic repercussions, including a ban on Japanese seafood imports and restrictions on group tourism. Additionally, potential export curbs on critical minerals vital for manufacturing could hinder Japan’s economic progress.

Potential Economic Setbacks

Economists warn that the combination of a tourism decline and restrictions on rare-earth exports could eliminate up to a year’s worth of anticipated economic growth. The outcome of the upcoming election will likely influence both domestic policies and international relations.