Investors Worry as AI Market Bubble Bursts

Recent developments in the artificial intelligence (AI) sector have sparked significant concerns among investors. Many are beginning to question whether the industry is caught in a major bubble, raising fears of a potential collapse that could severely impact the U.S. economy.

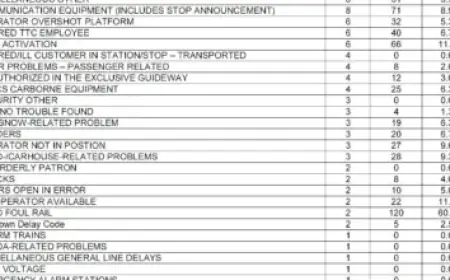

Tech Market Selloff

This week, the tech stock market experienced a dramatic selloff. Key players are witnessing substantial declines in their share prices. Notably, Amazon’s stock dropped by nine percent after revealing plans to spend a staggering $200 billion this year on AI advancements. Over the past five days, Amazon shares have declined over eight percent, reflecting deeper worries among investors.

Microsoft also faced challenges, with its shares falling nearly eight percent. This decline followed its largest single-day loss since the pandemic began. Other companies, such as Nvidia, Oracle, Alphabet, and Meta, have similarly experienced significant share price reductions as they continue investing heavily in AI infrastructure.

Financial Impact

The extensive investments in AI are staggering. According to reports, approximately $1.35 trillion in valuations has been erased from major tech companies. Collectively, these firms are projected to invest a remarkable $660 billion in AI this year alone. Jim Tierney, head of AllianceBernstein, described this figure as “breathtaking.”

The heavy spending is causing unease among investors, who express doubt regarding short-term returns from the AI infrastructure developments. Analysts highlight the emerging concerns over capital expenditures related to large language model (LLM) build-outs and the potential for over-expansion.

Amazon at the Forefront

Amazon stands out as the most significant investor in the AI race, targeting a 56 percent increase in spending compared to last year. However, this aggressive approach has not alleviated investors’ anxieties. Analyst Mamta Valechha from Quilter Cheviot notes a shift in investor sentiment, moving from fear of falling behind to questioning the sustainability of massive spending on AI initiatives.

Selective Investment Strategies

Contrarily, Apple has adopted a more cautious strategy, leading to a seven percent increase in its shares since Monday. This contrasts sharply with the broader tech market’s struggles, suggesting that investors are reassessing their investment strategies in AI. Fabiana Fedeli, chief investment officer for equities at M&G, indicates that investors are now more selective in choosing which companies to support in the AI sector.

Conclusion

The unfolding scenario in the AI market raises critical questions about the sustainability of mega-investments in this rapidly evolving field. As the tech industry faces scrutiny, investors will likely remain cautious and discerning in their approach to future AI-related opportunities.