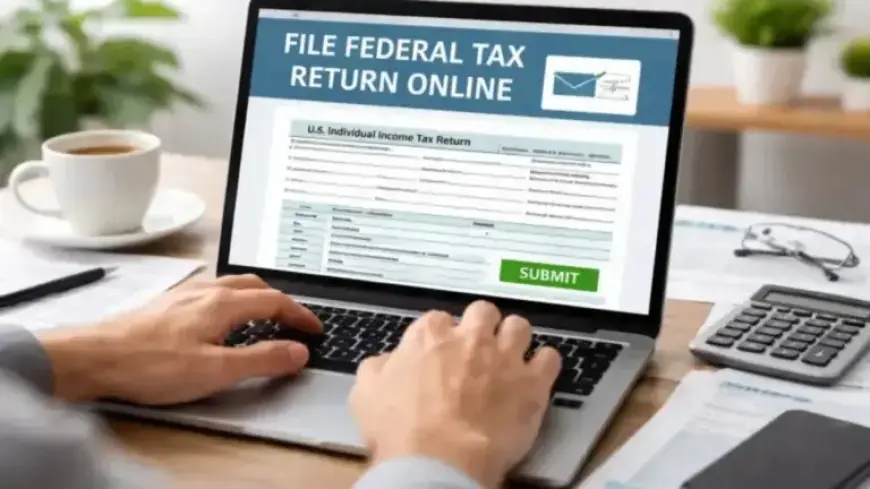

IRS Urges Taxpayers to Set Up Personal Online Accounts

The IRS is advancing taxpayer security and convenience with the introduction of Individual Online Accounts. This online portal offers a secure way for taxpayers to access their information, helping to prevent identity theft and fraud.

Benefits of Setting Up an Individual Online Account

An Individual Online Account provides numerous advantages, making tax management more straightforward. Key features include:

- 24/7 access to tax-related services

- Viewing refund statuses

- Accessing transcripts and payment history

- Downloading important documents like W-2s and 1099s

This online functionality mirrors online banking, allowing users to handle their tax affairs efficiently and without the delays inherent in traditional methods.

Expanded Features for 2025

Starting in early 2025, the IRS will expand the features of these accounts. Taxpayers can expect to access downloadable copies of essential tax documents, including:

- W-2 forms (Wage and Tax Statement)

- 1095-A (Health Insurance Marketplace Statement)

- Various 1099 forms, including those for non-employee compensation and interest income

These documents will be available for the years 2023, 2024, and 2025 and can be found under the “Records and Status” tab in the online accounts.

Streamlined Tax Management

The Individual Online Account simplifies several routine tax tasks. Users can:

- Check the status of refunds and amended returns

- Request an identity protection PIN

- Manage communication preferences

This platform minimizes the need for phone calls and physical paperwork, significantly enhancing the efficiency of managing tax responsibilities.

Encouragement for Tax Professionals

The IRS is also calling on tax professionals to encourage their clients to establish Individual Online Accounts. Through Tax Pro Accounts, professionals gain the ability to act on behalf of their clients, further streamlining the tax process.

By promoting the use of Individual Online Accounts, the IRS aims to enhance customer service, improve transparency, and empower taxpayers with better control over their information in a secure online environment. Establishing an Individual Online Account not only secures but simplifies tax management for users.