Wall Street’s Dumbest Scheme Faces Collapse

The stock market is witnessing a significant shift involving an unusual scheme centered on cryptocurrency investments. A company, formerly known as MicroStrategy and now rebranded as Strategy, has seen its stock trading practices come under scrutiny due to their questionable business model, which heavily relies on Bitcoin investments.

Overview of Strategy’s Business Model

Strategy generates substantial revenue through a combination of software sales and Bitcoin trading. In its most recent earnings report, the company reported $128 million in revenue. However, its primary business function appears to be the sale of stocks to investors, which funds its Bitcoin purchases.

Bitcoin Holdings and Market Value

- Strategy holds over 700,000 Bitcoins, valued at approximately $54 billion.

- As of Tuesday, the company’s market capitalization was around $41 billion.

- This equates to roughly $0.80 in Bitcoin value for every dollar of Strategy stock.

Market Performance and Concerns

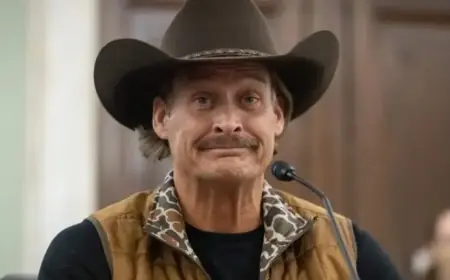

Despite the significant value of its Bitcoin assets, Strategy stock is experiencing a notable downturn. In the past six months, Bitcoin’s price declined by about 33%, while Strategy’s stock plummeted by 60%. The CEO, Michael Saylor, has responded by increasing the sale of stocks to buy more Bitcoin, raising concerns over the sustainability of this approach.

Historical Context

In 2020, Saylor made the decision to invest the company’s cash reserves into Bitcoin. This decision was particularly bold given the absence of cryptocurrency exchange-traded funds (ETFs) at the time. Individuals looking for Bitcoin exposure had limited options and turned to purchasing Strategy stock instead. Initially, this scheme was successful, with stocks trading significantly above the intrinsic Bitcoin value.

Shifting Landscape

The landscape is changing as the appeal of purchasing Bitcoin through stock diminishes. Now, investors have easier access to Bitcoin directly, which raises questions about the relevance of these middleman companies. As of early January, Strategy stock accounts for only 0.06% of popular market index funds.

Future Outlook

The future of Strategy and similar companies remains uncertain. While the potential for Bitcoin to rebound exists, the likelihood of a business model that charges a premium for Bitcoin exposure through stocks may be fading. This could suggest a reflection on society’s often overzealous investments in hype-driven technology sectors.

As new opportunities arise, attention may shift away from these volatile investments. Investors should proceed cautiously in this evolving market landscape, as the viability of crypto treasury companies like Strategy continues to be questioned.