Dollar Developments: What’s Impacting Its Fluctuations?

The value of the U.S. dollar is experiencing significant fluctuations, raising concerns among investors and analysts. Understanding these fluctuations is crucial as they impact global economic dynamics, particularly in stocks, bonds, and commodities.

Trends in Dollar Value and Global Investment

In 2025, international stocks saw substantial growth, outpacing the U.S. market. This shift marks a significant change from previous trends where the U.S. consistently led the global economy.

- International stocks gained over 33% in 2025.

- The S&P 500 and Nasdaq 100 lagged behind, highlighting a notable divergence.

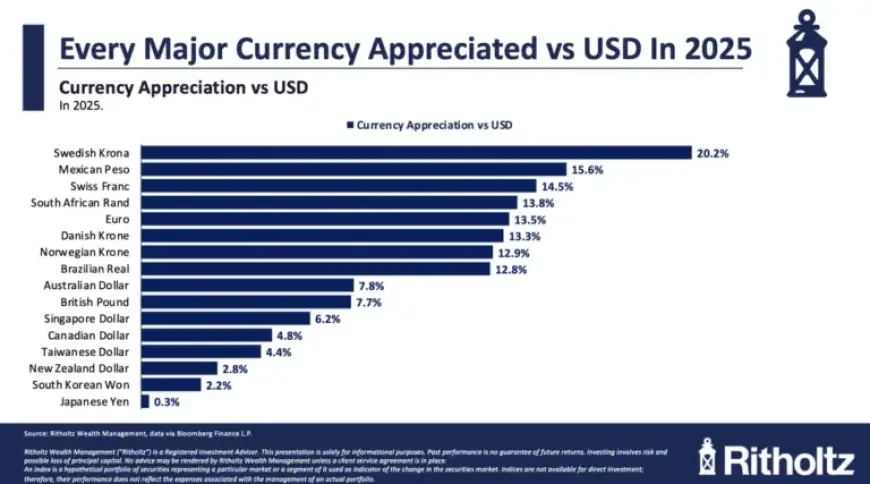

- The U.S. dollar weakened by 9.2%, the most significant decline since 2017.

Factors Contributing to Dollar Weakness

The decline of the dollar correlates with growing discontent from international trading partners. Tariffs and defense policies imposed by the U.S. have led these partners to reassess their investments in the U.S. market.

- Tariffs have strained relationships with key trade partners.

- Many foreign investors are reallocating their assets back to local markets.

- This trend is termed the “Repatriation Trade,” involving converting U.S. investments into local currencies.

Implications for the U.S. Economy

The repercussions of these investment shifts bear significant implications for the U.S. economy. As global investors withdraw capital, the U.S. dollar’s status as the world’s reserve currency is called into question.

- Investor sentiment indicates uncertainty regarding U.S. economic policies.

- The potential for long-lasting effects on U.S. financial markets exists.

- Continued dollar depreciation may prompt more aggressive measures from trading partners.

Future Outlook

The current U.S. administration may need to reconsider its approach to international relations to stabilize the dollar. Without changes, the ongoing trend of capital repatriation could persist.

Analysts remain cautiously optimistic about a potential recovery in dollar value but emphasize the need for responsive policies. Untangling the complexities of global economics will require thoughtful strategies that address investor concerns.

Understanding the background and implications of dollar fluctuations is essential for investors navigating the current landscape. As the situation develops, monitoring these trends will be crucial for informed decision-making.