Implications of Federal Reserve Losing Independence Explained

The ongoing discussion surrounding the Federal Reserve’s independence has intensified with the recent nomination of Kevin Warsh as the new chairman by President Donald Trump. Warsh, who served as a Fed governor from 2006 to 2011, was selected amid rising tensions regarding interest rate management and political influence over the central bank.

Historical Context of the Federal Reserve’s Independence

The independence of the Federal Reserve was significantly shaped during the Great Depression by Marriner Eccles. Appointed by President Franklin D. Roosevelt in 1934, Eccles redefined the Fed’s role, establishing its autonomy from political pressures. His remarkable leadership helped ensure that the central bank could act in the nation’s best long-term economic interests.

The Significance of a Politically Neutral Central Bank

According to Jason Kotter, a former Fed economist, maintaining the Fed’s independence is crucial for economic stability. The central bank has two core objectives: ensuring price stability and maximizing employment. However, political leaders often push for lower interest rates to stimulate short-term growth, which can lead to long-term inflation.

- History shows that political control over monetary policy can lead to volatility.

- Interest rates set too low for too long can result in an overheated economy.

- Public perception may overlook the Fed’s essential role in managing economic stability.

Potential Consequences of Political Interference

Kotter warns that if the presidency begins to control monetary policy, trust in the central bank could erode rapidly. Skepticism over political motives can increase long-term borrowing costs, counteracting the intended benefits of such policies.

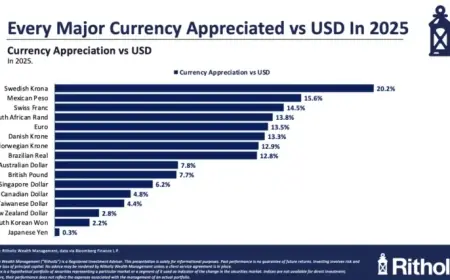

International Implications

Globally, countries with government-controlled central banks typically face economic instability and inflation, which results in decreased investor confidence. This pattern underlines the critical importance of independence for the Federal Reserve and similar institutions worldwide.

The Debate on Federal Reserve Accountability

Despite criticism regarding accountability, the Fed provides regular reports to Congress and maintains a high level of transparency. Fed chairpersons must report biannually to Congress, and the institution publishes its balance sheet weekly.

Public Perception and the Fed’s Mission

The Federal Reserve is often seen as complex and distant. Yet, its monetary policy decisions profoundly affect everyday financial realities, including mortgages and credit card rates. Understanding its mission is vital, as the Fed is primarily focused on economic stability rather than profit.

Conclusion: The Legacy of Maree Eccles

Marriner Eccles remains a pivotal figure in discussions about the Fed’s independence. His tenure reinforced the necessity of a central bank that operates without political influence. Today, as the debate continues about the Federal Reserve’s role and independence, Eccles’ legacy serves as a reminder of the importance of sound monetary policy for the nation’s economic health.