Tech Giant Disrupts Gold and Global Markets

Recent developments in the commodities market have shown a shift following a period of significant selloffs. Gold and silver prices have notably rebounded, indicating stabilization after a tough phase in the metals sector.

Tech Giant Disrupts Gold and Global Markets

On February 3, 2026, the metals market experienced a notable recovery. Major players like JPMorgan are pushing back against the downturn, asserting the fundamental strength of gold.

Market Trends

- Gold and silver prices rose on February 3, 2026.

- Commodities are viewed as more stable investments compared to stocks, bonds, and cash.

JPMorgan and other financial institutions advocate for the enduring value of real assets, emphasizing the importance of commodities during turbulent economic times. This perspective is reshaping investor attitudes towards precious metals amidst ongoing market fluctuations.

Key Insights

The recent selloff in the gold and silver markets might have paused, but the potential for continued growth remains. Investors are encouraged to consider diversifying their portfolios with commodities and real estate.

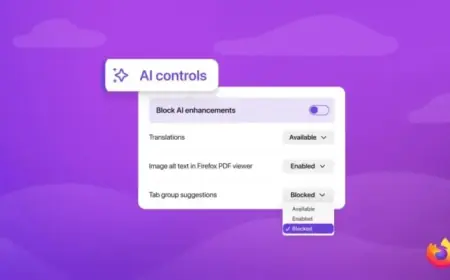

As global markets fluctuate, the interplay between technology advancements and traditional investing strategies becomes increasingly pivotal. Observers will be watching how tech developments continue to impact commodity markets, including gold.