Obamacare Subsidy End Pushes Some Americans Toward Financial Instability

The expiration of additional subsidies under the Affordable Care Act (ACA), often referred to as Obamacare, has left many Americans facing significant financial challenges. As the open enrollment period ends, a notable decline in marketplace enrollment has been recorded, highlighting a crisis that could influence the upcoming midterm elections.

Impact of Subsidy Expiration

Recent data indicates a drop of at least 1.3 million participants in health insurance marketplaces compared to the previous year. This decline underscores the financial strain facing individuals who are now subject to higher healthcare costs as a result of subsidy reductions.

Who is Affected?

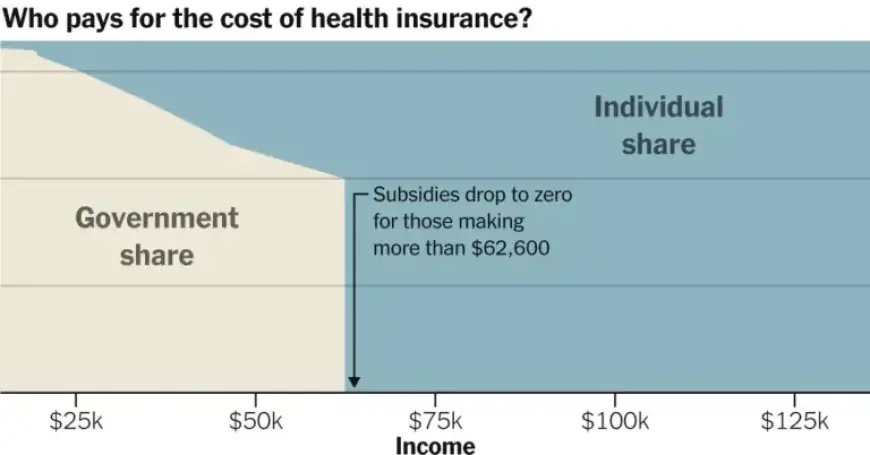

- Individuals who earn slightly above the subsidy limit are seeing pronounced increases in their health insurance costs.

- Those earning just below the threshold often pay around 10% of their income for an average health plan, in stark contrast to those just above the limit.

- The cost increases can total several thousand dollars annually for older adults, especially those near the cutoff income limits.

Historical Context of Obamacare Subsidies

The Affordable Care Act was structured with certain fiscal constraints, creating a “cliff” effect that impacts those near the subsidy income thresholds. Initially designed to limit the overall cost of the legislation, this structure has led to increased financial burdens for individuals as healthcare costs continue to rise.

Changes During the Pandemic

During the COVID-19 pandemic, temporary adjustments to the ACA made subsidies more accessible to low-income individuals, with some receiving plans at no cost. However, these enhancements expired at the end of 2022 due to a lack of congressional consensus on extending the funding.

Consequences of the Cliff Effect

The discontinuation of enhanced subsidies has created a phenomenon known as “sticker shock” across the nation. Many individuals are now confronting the reality of substantially higher health insurance premiums, which can consume a larger percentage of their income.

Economic Risks

- Some individuals have resorted to depleting their savings to afford premiums.

- Others have downgraded their health plans or opted to forgo insurance entirely.

Future Prospects

Discussions around a possible bipartisan solution to extend subsidies are ongoing, but the outcomes remain uncertain. Economists highlight the growing significance of the subsidy cliff, especially for those with incomes near the threshold.

As policymakers navigate the complexities of health insurance funding, the implications of subsidy reductions continue to resonate with millions of Americans. Understanding these developments is crucial for individuals as they plan for their healthcare needs amidst changing policy landscapes.