Today’s MCX Gold and Silver Rates: Delhi, Mumbai, Bengaluru Update

Gold and silver prices have experienced significant fluctuations recently in India. As of February 2, 2026, gold rates per 10 grams in major cities are as follows:

Today’s MCX Gold and Silver Rates: Delhi, Mumbai, Bengaluru Update

- Bengaluru: ₹160,690 (24K Gold), ₹361,000 (Silver)

- Delhi: ₹160,860 (24K Gold), ₹367,000 (Silver)

- Mumbai: ₹160,720 (24K Gold), ₹366,000 (Silver)

- Chennai: ₹162,660 (24K Gold), ₹334,000 (Silver)

- Kolkata: ₹160,700 (24K Gold), ₹362,000 (Silver)

- Pune: ₹160,740 (24K Gold), ₹368,000 (Silver)

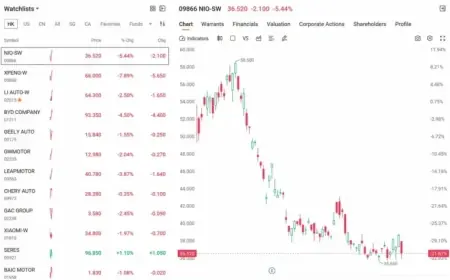

Market Trends and Impact

After the presentation of the Union Budget 2026, gold prices fell by approximately 3%, while silver prices experienced a more drastic 9% decrease. The 24-carat gold rate on the Multi Commodity Exchange (MCX) dropped to ₹1,36,185 from an opening price of ₹1,46,800 per 10 grams on Budget day.

Factors influencing these price shifts include currency fluctuations, global demand, and government policies. A weakening rupee against the US dollar often leads to higher gold prices in India.

Understanding Gold Purity

Gold is categorized into different types based on purity, primarily 24K and 22K. 24K gold, known as pure gold, consists of 99.9% gold and is too soft for jewelry production. Conversely, 22K gold comprises 22 parts gold and 2 parts other metals, making it suitable for crafting jewelry.

Annual Gold Demand in India

India is the largest importer of gold, with annual imports ranging from 800 to 900 tonnes, primarily to satisfy the jewelry industry’s demand. The price of silver, often correlated with gold, is influenced by various factors including industrial demand and inflation.

Current Investment Climate

With rising uncertainty in global markets, investors are increasingly turning to gold as a haven. Gold is not only considered a safe investment but also serves as a hedge against inflation.

The Bureau of Indian Standards (BIS) oversees gold hallmarking in India, ensuring the purity of gold sold in the market. This certification protects buyers from adulteration and assures the quality of their investment.

For those looking to invest in silver, the current market dynamics suggest that now could be an advantageous time due to its potential for price appreciation.