Blairmore Loses Bank Branch Amid Nationwide Trend in Canada

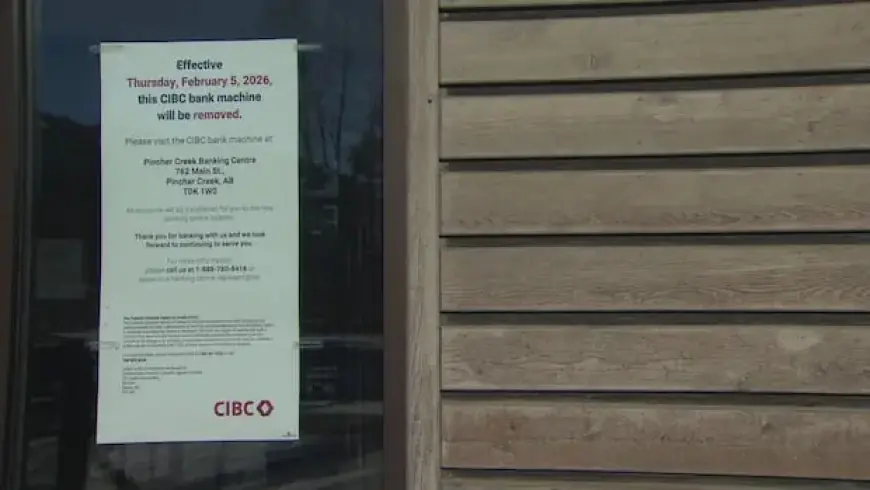

Residents of Blairmore, Alberta, are facing the impending closure of their local CIBC branch, scheduled for February 5. This decision is part of a broader trend of bank branch closures affecting small communities across Canada.

Blairmore’s Banking Challenges

Valerie Robinson, a loyal CIBC customer for nearly 30 years, expressed her dissatisfaction with the bank’s decision. Blairmore, a community of around 1,500 people, will lose not only its CIBC branch but also its ATM, complicating access to cash for residents.

Locals rely on cash for various transactions, including fundraising and community events. Robinson highlighted that alternatives like debit machines are impractical for small-scale efforts, such as selling raffle tickets.

Banking Alternatives and Community Reactions

Blairmore does have other banking options, including Scotiabank, RBC, and ATB. However, Robinson and others fear that switching banks could be risky if more branches follow suit. Many residents voiced their concerns online, illustrating a community anxious about the future of in-person banking.

- CIBC closed 12 branches in small Alberta towns between 2014 and 2024.

- Calgary and Edmonton only lost two branches each during the same period.

- Overall, Alberta has seen a 9% decrease in bank branches despite a population growth of 21%.

Nationwide Trends in Bank Branch Closures

The Canadian Bankers Association reports a nationwide reduction of about 6% in bank branches from 2020 to 2024. This trend is particularly pronounced in rural regions, where residents often travel much farther than urban dwellers to access banking services.

Data indicates that the number of Canadians living in small towns without bank branches increased by 2% from 2019 to 2023. Between 2019 and 2023, the country experienced the closure of 561 bank branches and over 900 ATMs, even as the population grew by nearly 7%.

The Impact of Bank Closures

Communities like Vauxhall, Alberta, serve as cautionary examples. The town has been without a major bank since Scotiabank’s closure in 2022. The loss of banking services significantly impacts residents, particularly seniors, who find it difficult to travel for basic banking needs.

Consumer Perspectives on Banking Services

Despite the rise of online and mobile banking, consumer advocate Sylvie De Bellefeuille emphasizes the necessity of in-person banking interactions for resolving complex issues and fraud prevention.

CIBC’s Justification for Closure

CIBC’s rationale for the Blairmore branch closure cites prolonged lower business volumes. The bank pointed out that many transactions have shifted to online platforms, suggesting a decline in the need for physical banking locations.

The Financial Consumer Agency of Canada mandates that banks provide advance notice of branch closures. In Blairmore’s case, local residents were informed, yet many felt the decision had already been finalized by the time they were notified.

The impact of these closures raises significant concerns for small communities, with many residents feeling uncertain about the future of their banking services.