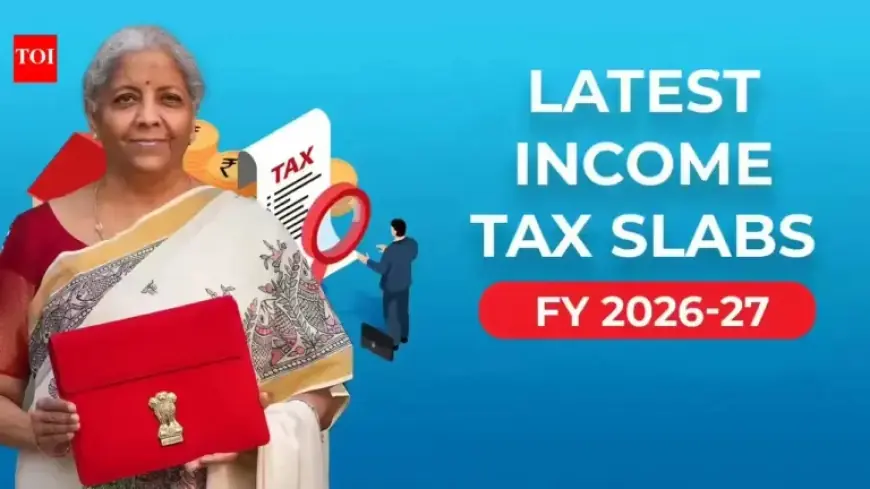

Income Tax Slabs FY 2026-27: New vs. Old Regime Rates Explained

The Finance Minister, Nirmala Sitharaman, has announced that the income tax slabs for FY 2026-27 will remain unchanged. This applies to both the old and new income tax regimes. The decision aligns with expectations as last year’s budget saw major revisions to the new regime. Taxpayers can continue to assess their liabilities based on the income tax slabs that have been effective since FY 2025-26.

Income Tax Slabs FY 2026-27: New Regime Overview

Under the new income tax regime, the basic exemption limit is set at Rs 4 lakh. The income tax rates are structured progressively:

- Income up to Rs 4 lakh: Nil

- Rs 4 lakh to Rs 8 lakh: 5%

- Rs 8 lakh to Rs 12 lakh: 10%

- Rs 12 lakh to Rs 16 lakh: 15%

- Rs 16 lakh to Rs 20 lakh: 20%

- Rs 20 lakh to Rs 24 lakh: 25%

- Above Rs 24 lakh: 30%

For individuals earning approximately Rs 1 lakh monthly, the tax liability is effectively zero. However, for those earning above Rs 2 lakh per month, the applicable tax rate escalates to 30%.

Income Tax Slabs Under the New Regime

| Income Range | Tax Rate |

|---|---|

| 0 – 4 lakh | Nil |

| 4 – 8 lakh | 5% |

| 8 – 12 lakh | 10% |

| 12 – 16 lakh | 15% |

| 16 – 20 lakh | 20% |

| 20 – 24 lakh | 25% |

| Above 24 lakh | 30% |

Income Tax Slabs FY 2026-27: Old Regime Overview

The old income tax regime remains static and requires taxpayers to choose it explicitly during their return filing. If an individual fails to file their Income Tax Return (ITR) by July 31, they are automatically switched to the new tax regime.

Income Tax Slabs Under the Old Regime

- Income up to Rs 2.5 lakh: Nil

- Rs 2.5 lakh to Rs 5 lakh: 5%

- Rs 5 lakh to Rs 10 lakh: 20%

- Above Rs 10 lakh: 30%

This regime offers numerous deductions and exemptions, although it has higher tax rates at lower income levels. Notably, the basic exemption limit varies for senior citizens and super senior citizens:

- Senior citizens (60 years and above): Rs 3 lakh

- Super senior citizens (80 years and above): Rs 5 lakh

Popular Deductions Under the Old Regime

- Standard deduction

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Section 80C (including PPF and NPS)

- Section 80D (medical insurance)

- Section 80TTA (bank interest)

- Section 80G (donations)

- Home Loan Interest Benefit

The new regime continues to be the default option for taxpayers, emphasizing streamlined taxation without the complexity of deductions.