Microsoft Stock Dips Amid Strong Cloud Growth: Buy the Dip Now?

Microsoft’s stock has recently experienced a decline despite robust quarterly results for the second quarter of fiscal 2026. This drop, attributed to increased operating expenses and reliance on OpenAI, raises questions among investors regarding whether to buy the dip.

Key Financial Metrics

- Current Price: $430.29

- Market Capitalization: $3.2 trillion

- 52-Week Range: $344.79 – $555.45

- Day’s Range: $426.45 – $439.60

- Volume: 59 million

- Average Volume: 27 million

- Gross Margin: 68.59%

- Dividend Yield: 0.79%

- Daily Change: -0.74% (-$3.21)

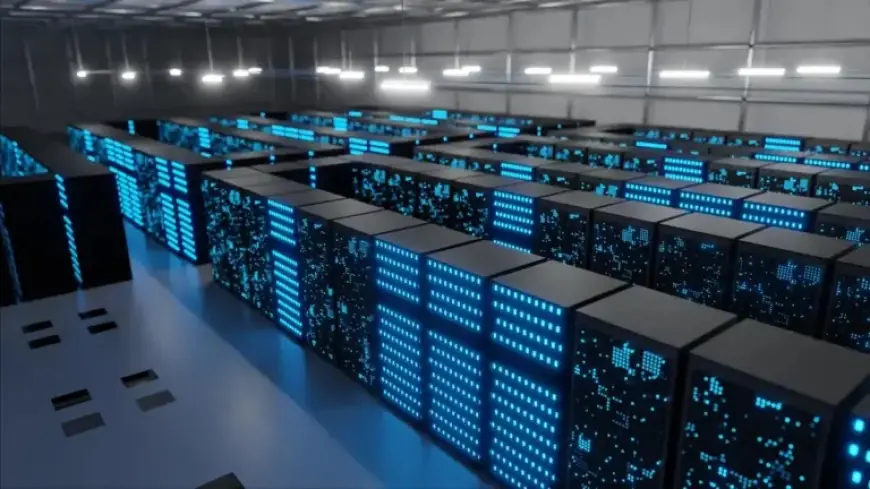

Strong Cloud Growth

The cloud computing segment, particularly Azure, has emerged as a significant growth driver for Microsoft. Azure’s revenue surged by 39% year over year, marking the tenth consecutive quarter this metric has exceeded 30% growth. High demand for compute power and AI services is fueling this momentum.

Quarterly Revenue Highlights

In total, Microsoft reported a 17% increase in revenue, amounting to $81.3 billion. Adjusted earnings per share (EPS) reached $4.14, exceeding analyst expectations of $3.97. Key insights include:

- Intelligent Cloud Revenue: Increased by 29% to $32.9 billion.

- Productivity and Business Processes Revenue: Rose by 16% to $34.1 billion.

- Microsoft 365 Consumer Cloud Revenue: Jumped by 29%.

Challenges in Other Segments

Conversely, the revenue for Microsoft’s “more personal computing” segment, which includes Windows and Xbox, fell by 3% to $14.3 billion. Despite this, its search and news advertising sector saw a 10% revenue increase. Notable changes include:

- Xbox Revenue: Decreased by 5%.

- Windows OEM Revenue: Grew by 1%.

Future Outlook

For the upcoming third quarter, Microsoft forecasts revenue between $80.65 billion and $81.75 billion. Analyst estimates place anticipated revenue at $81.19 billion. Azure is expected to exhibit continued growth, with predictions of a 37% to 38% increase in constant currencies.

Should You Buy the Dip?

The stock currently trades at a forward price-to-earnings (P/E) ratio of 26 times based on fiscal 2026 estimates and 23 times based on fiscal 2027. This pricing suggests potential value given its growth trajectory. Azure will likely remain a critical growth engine, bolstered by its partnership with OpenAI. Meanwhile, Microsoft’s Copilot AI assistant has shown significant traction, with daily active users increasing tenfold year over year.

In summary, despite its reliance on OpenAI carrying some risk, the strength in Azure and ongoing growth could present a favorable buying opportunity for investors considering the current dip in Microsoft stock.