Ripple Treasury Respects Clients’ Crypto Hesitancy, Executive Confirms

Ripple has unveiled Ripple Treasury, a new service aimed at corporate treasury management. This launch follows the company’s recent acquisition of GTreasury for $1 billion, completed just three months prior. The company’s executives acknowledge client hesitancy towards adopting cryptocurrency technology but emphasize that such integration is optional.

Overview of Ripple Treasury

Ripple Treasury serves as a modern solution for corporate money managers. It allows clients to utilize blockchain features without the requirement to engage with cryptocurrency. Renaat Ver Eecke, CEO of GTreasury, confirmed this during a recent webinar.

Client Perspectives on Crypto Technology

- Clients show interest in digital assets.

- Skepticism remains among some executives.

- Adoption of blockchain technology is voluntary.

Ver Eecke expressed the need to educate clients about the advantages of incorporating stablecoins into their treasury management. He noted that despite some reservations, the digital asset space can offer another option for corporate finance.

Background of GTreasury

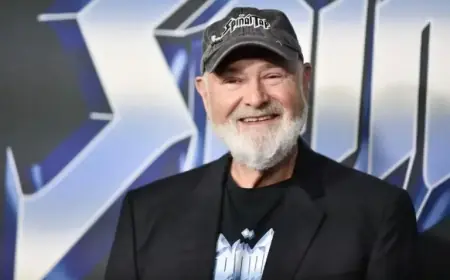

GTreasury has more than forty years of experience in providing treasury solutions for Fortune 500 companies. This background offers a solid foundation as Ripple integrates its services. Ripple’s CEO, Brad Garlinghouse, highlighted the potential of blockchain to address inefficiencies within legacy money management systems.

Benefits of Blockchain Technology

Blockchain’s near-instant settlement capabilities can drastically reduce the time and costs associated with traditional financial transactions. This enables companies to optimize cash flow and manage funds more efficiently.

Future Initiatives and Support

Ripple Treasury aims to provide “tech credits” for clients curious about exploring digital assets. This initiative seeks to alleviate concerns about funding such ventures. Ver Eecke stated, “If you’re thinking about exploring [digital assets] but have a challenge about ‘how [do] I fund it,’ please reach out to us.”

By promoting a gradual adoption process, Ripple hopes to empower corporate treasurers and CFOs to find relevant cases for utilizing blockchain technology.

Conclusion

In summary, Ripple Treasury respects clients’ hesitancy toward cryptocurrency, while presenting them with an optional and potentially transformative financial solution. As more companies explore these possibilities, the future of corporate treasury management could be significantly impacted by blockchain advancements.