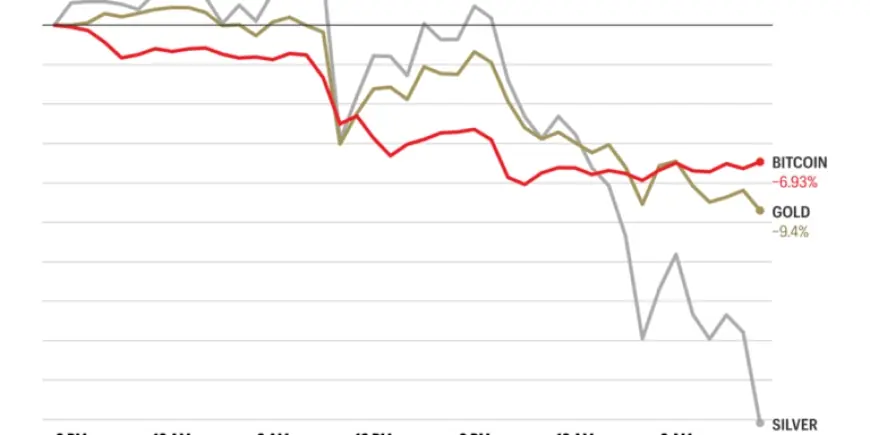

Bitcoin Plummets Towards $80,000 Amid Precious Metals Decline

The recent decline in Bitcoin’s value is attracting widespread attention in financial markets. The cryptocurrency has dipped nearly 2% over the last 24 hours, reaching a low of approximately $81,000. This price marks its lowest point since April and falls below the previous support level of $82,175 recorded in November.

Current Market Status for Bitcoin

As of the latest reports, Bitcoin is trading around $82,290, indicating a slight recovery from its recent low. However, this downturn is not isolated, as other cryptocurrencies have also experienced significant losses. Ethereum, for instance, fell by 4% and is currently priced at about $2,660.

Impact on Precious Metals

This week has also seen a dramatic decline in precious metals, a sector that had been experiencing robust gains. Current figures show:

- Gold: Down 11% in the last day.

- Silver: Dropped 31% recently.

- Platinum and Copper: Both are facing declines as well.

Market Influences and Reactions

The volatility in both cryptocurrency and metals markets is perceived as being influenced by recent political announcements and corporate performance. President Donald Trump’s nomination of Kevin Warsh for the U.S. Federal Reserve chair position has raised investor concerns. Additionally, Microsoft’s recent earnings report, although strong, did not alleviate worries regarding heavy investments in artificial intelligence (AI), leading to a 10% drop in its stock during after-hours trading.

Experts suggest that these fears, particularly concerning AI spending without corresponding earnings, have contributed to a broader decline in risk assets, including cryptocurrencies. Matt Howells-Barby from the crypto exchange Kraken noted that this trend of declining asset prices may have started with the downturn in tech stocks like Microsoft.

Historical Context and Future Outlook

Analyzing the recent performance of Bitcoin reveals a worrying trend. Since October, Bitcoin’s value has plummeted over 30%, diverging from the S&P 500, which has seen a slight increase of nearly 3% in the same period. This lack of alignment raises concerns about Bitcoin’s future performance as the market trends toward bearish territory.

Despite these challenges, there are glimmers of optimism. Institutional interest in stablecoins and potential new regulations in the cryptocurrency space have some market analysts cautiously hopeful. Alex Kuptsikevich from FxPro expressed that the current downturn may simply represent a “mild Crypto Winter,” indicating a potential recovery in the future.