Indonesia Promises Market Reform Following $80 Billion Crash; Bourse Chief Resigns

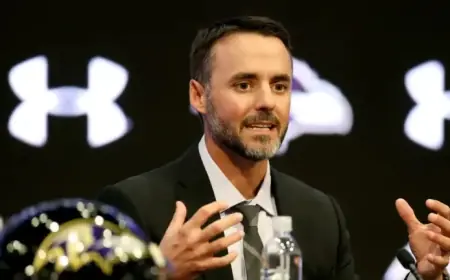

Amid significant turmoil in Indonesia’s financial markets, the country’s economic leaders are promising reforms to enhance transparency and governance. This commitment follows the resignation of the CEO of the Indonesia Stock Exchange, Iman Rachman, in response to an $80 billion market decline.

Market Turmoil and Leadership Changes

The Jakarta Composite Index experienced a sharp drop of over 8% within two days this week. This decline prompted concerns from MSCI regarding the potential downgrade of Indonesian stocks to frontier market status. In light of these events, Iman Rachman stepped down from his position. He expressed hope that his resignation would benefit the capital market.

Government’s Response and Proposed Measures

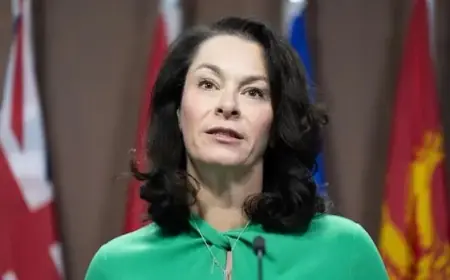

In a press conference, Chief Economic Minister Airlangga Hartarto outlined the government’s strategy to restore confidence. Key proposed reforms include:

- Doubling the free float requirement for publicly traded shares to 15%.

- Increasing the capital market investment cap for pension and insurance funds from 8% to 20% of their total portfolios.

- Implementing checks on shareholder affiliations for those holding less than 5% ownership.

Hartarto emphasized the government’s commitment to protecting investors through improved governance and transparency. The Financial Services Authority (OJK) will manage the implementation of these reforms and aims to resolve MSCI’s concerns by May.

Investor Reactions and Market Sentiment

Market analysts have noted a mix of scepticism and cautious optimism among investors. Although the stock market gained 1.18% following the announcement of the proposed measures, sentiment remains fragile. Foreign investors offloaded approximately $645 million in shares during the recent selloff, reflecting growing apprehensions about President Prabowo Subianto’s fiscal policies.

Paul Dmitriev, a senior analyst at Global X ETFs, commented on the urgency for policymakers to address these issues to avoid substantial systemic outflows that could disrupt the market significantly.

Future Outlook

The OJK has reassured investors that operations will continue smoothly despite the leadership change. Communication with MSCI has been fruitful, with expectations for positive feedback on the proposed reforms.

As Indonesia navigates these challenges, the government’s emphasis on reform aims to restore investor confidence and stabilize the financial market amidst a tumultuous economic landscape.