U.S. Loosens Sanctions on Venezuelan Oil Industry

The U.S. is loosening sanctions on Venezuela’s oil industry, allowing greater involvement from U.S. firms. This shift follows the removal of President Nicolas Maduro by U.S. forces earlier this month.

Key Developments in U.S. Sanctions on Venezuelan Oil Industry

The U.S. Treasury Department has issued a broad license that permits transactions related to Venezuelan oil. This applies specifically to the government and the state oil company, PDVSA. However, it does not lift sanctions on oil production.

Overview of the New License

- Permits involve various activities including export, sale, and transportation of Venezuelan crude oil.

- Designed to enhance investment in Venezuela’s oil sector.

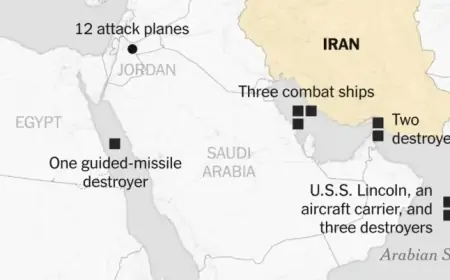

- Excludes transactions with entities in countries such as Russia, Iran, North Korea, and Cuba.

According to a White House official, this measure aims to facilitate the flow of existing oil while maintaining existing production sanctions. It indicates a clear “America First” stance, prioritizing U.S. interests in Venezuela’s recovery.

Impact on U.S. Investment

The allowed transactions could potentially unleash billions in U.S. investments. Companies like Chevron and Repsol have recently sought such licenses to boost output and exports from Venezuela, an OPEC member.

Jeremy Paner, a legal expert, stated that the authorization opens many operational areas for U.S. firms but is limited as it excludes foreign companies. Kevin Book, an analyst, noted that this change maintains rigorous standards for non-U.S. entities while providing clarity for American investors.

Further Context on Restrictions

The new licenses come amid legislative changes in Venezuela aimed at reforming the oil sector. Notably, a recent amendment enables greater autonomy for private producers and encourages new contracts.

However, there are concerns about the viability of PDVSA. The exclusion of Russian and Chinese partnerships, which account for approximately 22% of oil production, raises questions about the ability to export and market oil effectively.

Future Prospects

The Trump administration envisions a $100 billion reconstruction plan for Venezuela’s oil industry. They plan to oversee oil sales as part of this initiative, building on an earlier agreement to export crude oil to U.S. refiners.

As this situation develops, it highlights the complexities of U.S.-Venezuelan relations and the potential for significant changes in the global oil market.