Trump Strikes Russia More Potently Than Ukrainian Missiles

In a significant development, Russian oil company Lukoil has agreed to sell its foreign assets to an American investment firm. This decision signals the impact of the U.S. sanctions, imposed during President Donald Trump’s administration, against Russia. Valued at approximately $22 billion, this sale could severely affect the Kremlin’s financial situation.

Impact of U.S. Sanctions on Lukoil

Lukoil is recognized as Russia’s largest non-state enterprise by revenue. Unlike other Russian energy firms like Rosneft, which are state-controlled, Lukoil had a substantial international presence. It owned around 200 gas stations in the U.S., predominantly located in New Jersey, New York, and Pennsylvania.

The sanctions against Lukoil emerged following the Russian invasion of Ukraine in February 2022. In October 2025, the Trump administration enacted targeted sanctions aimed at reinforcing economic pressure on Russia due to its military actions.

Details of the Sanctions

- The U.S. sanctions “blocked” all property and interests of Lukoil located within the U.S. or controlled by American entities.

- These sanctions extended beyond the parent company to various subsidiaries and affiliates.

- Britain imposed its own restrictions targeting Lukoil and other firms connected to Russia’s oil exports.

- Treasury Secretary Scott Bessent labeled Lukoil as part of “the Kremlin’s war machine,” emphasizing the need for immediate ceasefire in Ukraine.

Consequences for the Russian Economy

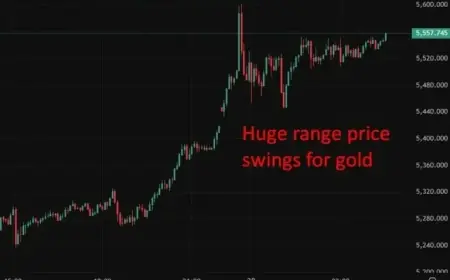

The divestment of Lukoil’s foreign assets represents a critical blow to Russia, especially concerning its tax revenues. Historically, Lukoil’s international operations generated consistent profits that contributed significantly to Russia’s federal budget. Reports indicate a projected 46% fall in federal budget proceeds from oil and gas taxes for the current month, down to approximately 420 billion rubles ($5.41 billion).

This situation underscores the Kremlin’s increasing dependence on oil and gas revenues, which constitute about one-third of total budget receipts. With wartime expenditures escalating, the loss of Lukoil’s international assets will exacerbate fiscal pressures.

Looking Ahead: Russia-Ukraine Peace Talks

While there are diplomatic efforts underway to resolve the conflict in Ukraine, significant barriers remain. Ukrainian President Volodymyr Zelensky indicated that a new round of U.S.-Russia talks may be scheduled for February 1, but he expressed the need for urgency in accelerating these discussions.

Analysts suggest that the Kremlin remains unyielding, believing time is on its side as Western support may weaken over time. In the meantime, Russia is boosting its military ranks to maintain operational strength along the extensive front line.

The sale of Lukoil’s assets highlights the influence of sanctions imposed by the U.S. and their profound effect on Russia’s economy. As the situation develops, the ability of the Kremlin to sustain its military financial viability may increasingly come into question.