Tuesday’s Rate Hike Poses ‘Bitter Pill’ for Middle Australia

The potential increase in interest rates by the Reserve Bank of Australia (RBA) poses significant challenges for many households, particularly in middle Australia. Consumer advocates are deeply concerned that a rate hike could push struggling families over the edge.

Impending Rate Hike and Its Impact on Households

Nadia Harrison, CEO of Mortgage Stress Victoria, emphasizes the precarious financial positions many Australians occupy. “A rate rise would be the straw that breaks the camel’s back for a lot of our clients,” she warns. With approximately one-in-three Australians having home loans, this demographic largely relies on variable interest rates.

Analysts predict another rate increase during the RBA’s upcoming meeting. Current inflation rates, now at 3.8%, exceed the central bank’s target. This scenario likely facilitates the anticipated rate hike.

Statistics on Financial Distress

- 1.3 million households could face mortgage stress due to a 0.25% rate increase, according to Roy Morgan data.

- 30% of callers to the National Debt Helpline are in full-time employment, highlighting that financial struggles are affecting employed individuals as well.

- During the latter half of 2025, over 83,000 Australians reached out for financial assistance, with 11% reporting mortgage stress.

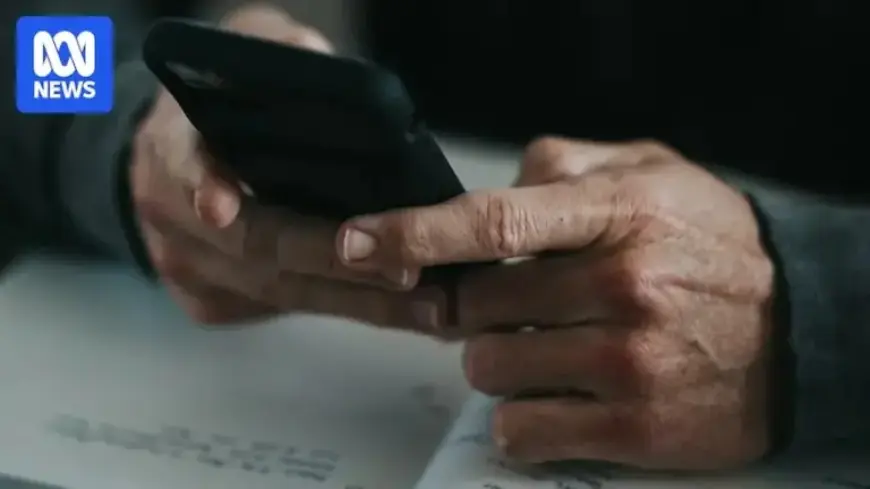

Domenique Meyrick, CEO of Financial Counselling Australia, notes that the demand for financial guidance is rising among middle-income households. Many of these individuals are not low-income earners but rather employed citizens who are overwhelmed by rising costs.

Cost of Living Pressures

Hourly wage earners are now confronting an increased burden from everyday expenses. Dr. Meyrick points out that many callers are skipping meals or delaying medical appointments to manage their finances. “These are people who can’t sleep at night, worrying about their next bill,” she states.

The impact of the rising cost of housing significantly contributes to this stress, as many borrowers are facing substantial financial pressure from both higher living costs and anticipated mortgage increases.

Historical Context of Rate Changes

The current financial landscape traces back to the COVID-19 pandemic. In response to the economic downturn in 2020, the RBA had cut interest rates. However, after inflation surged in 2021, rates began to rise again through 2022 and 2023. While there was a brief reprieve in 2024, recent inflation reports signal that rates may soon increase again.

Advice for Borrowers

Experts recommend that those experiencing financial hardship contact their lenders early. Banks are obliged to offer support to borrowers facing difficulty. Harrison notes the psychological burden associated with financial problems, warning that many people avoid dealing with lenders due to stress.

As economic pressures escalate, it is crucial for Australians to seek assistance. Acting early can facilitate better outcomes for those grappling with potential financial instability. The looming rate hike is a bitter pill for many, but support is available for those who reach out.