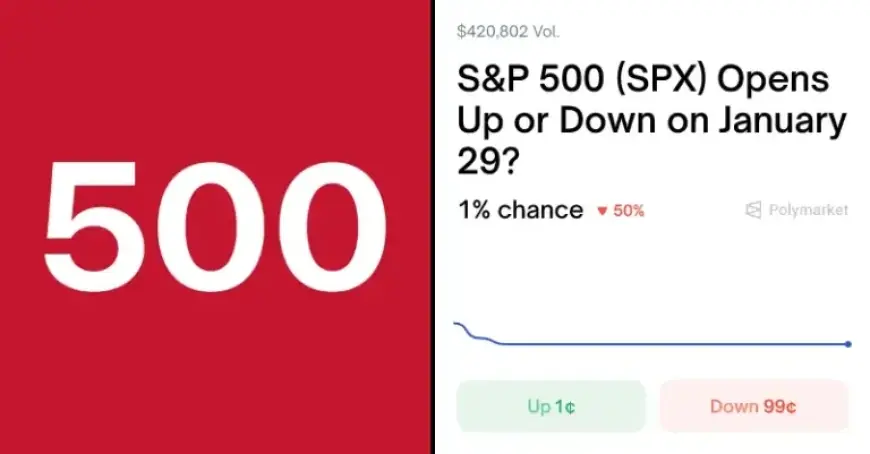

S&P 500 (SPX) January 29th Forecast: Betting Odds and Predictions

The S&P 500 Index (SPX) plays a significant role as a barometer for U.S. stock market performance. Investors closely monitor its opening and closing prices to gauge market trends and make informed decisions.

S&P 500 (SPX) Predictions for January 29

On January 29, the market will assess whether the SPX opening price is higher or lower than the closing price from the most recent trading day. This evaluation is crucial for investors and can dictate their strategies moving forward.

Market Resolution Criteria

The conditions for market resolution are straightforward:

- If the opening price on January 29 is higher than the previous closing price, the market resolves to “Up.”

- If the opening price is lower, it resolves to “Down.”

- If the two prices are equal, the outcome is a 50-50 resolution.

Factors Influencing the Market

Several circumstances can affect the resolution:

- The official closing price used is from the most recent trading day, which is typically the previous Friday unless a market holiday occurs.

- If trading does not occur on the specified day, the market will operate under a 50-50 resolution.

- In cases where trading halts or disruptions prevent a closing price, the last valid on-exchange trade price will be leveraged instead.

- Shortened sessions, typically due to holiday schedules, still refer to the official open and close prices designated for that day.

Data Sources for Price Resolution

The Wall Street Journal serves as the authoritative source for the SPX’s open and close values. Investors looking for up-to-date statistics can reference the following links:

Understanding these factors is essential for effectively predicting the S&P 500’s movements on January 29. Investors are encouraged to remain informed for better decision-making.