Bitcoin’s “Mine Canary” Signals Fed Stress, Warning of Looming Liquidity Trap

Amid uncertainties surrounding precious metals, a weakening dollar, and geopolitical tensions, Bitcoin continues to signal stability despite concerns in the market. The economic indicators suggest that while there are mild stressors, the financial conditions relating to liquidity and credit remain relatively relaxed. Observations from various financial indexes indicate that Bitcoin’s market strength is resilient for the time being.

Current Economic Indicators: Bitcoin’s Canaries

Recent data from the Chicago Fed illustrates that the National Financial Conditions Index (NFCI) stood at -0.590 for the week ending January 16, 2026. This measure indicates looser financial conditions, suggesting that the environment for funding is easier than average. A similar trend was observed in the adjusted NFCI, with a reading of -0.586.

- National Financial Conditions Index (NFCI): -0.590 (Week ending January 16, 2026)

- Adjusted NFCI: -0.586 (Week ending January 16, 2026)

- St. Louis Fed Financial Stress Index (STLFSI4): -0.651 (Week ending January 16, 2026)

These figures reflect a stable environment for businesses and investors, with no immediate signs of distress in credit markets.

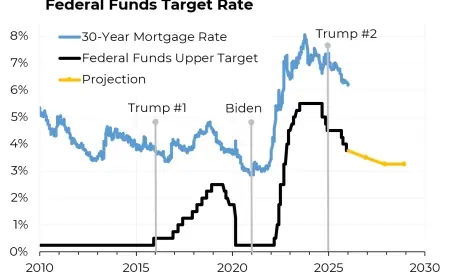

Rates Volatility and Market Responses

The ICE BofA MOVE Index, which assesses rates volatility, closed at 56.12 on January 27, 2026. This low reading indicates minimal concern regarding market upheaval that could affect equities, credit, and cryptocurrencies.

- MOVE Index: 56.12 (January 27, 2026)

- ICE BofA High Yield OAS: 2.69 (January 26, 2026)

- ICE BofA Corporate OAS: 0.74 (January 26, 2026)

- ICE BofA BBB OAS: 0.94 (January 26, 2026)

These tight spreads indicate that the credit market remains stable, reflecting a lack of panic among lenders and investors.

Liquidity Indicators Affecting Bitcoin

The liquidity landscape appears to be undergoing subtle shifts. According to the Federal Reserve’s data, total assets were valued at $6.585 trillion as of January 21, 2026. The Treasury General Account rose to $869 billion, indicating a tighter liquidity environment even with stable financial stress measures.

| Indicator | Value (Date) |

|---|---|

| Total Fed Assets | $6.585 trillion (January 21, 2026) |

| Treasury General Account (TGA) | $869 billion (January 21, 2026) |

| Reserve Balances | $2.955 trillion (January 21, 2026) |

| Overnight RRP Usage | $1.253 billion (January 27, 2026) |

These changes signal a potential tightness in liquidity that could affect Bitcoin indirectly, despite the current lack of overt stress in the market.

Bitcoin ETF Flows: The Canary in the Crypto Mine

Bitcoin’s exchange-traded fund (ETF) flows have recently experienced significant outflows, totaling -$102.8 million on January 27, 2026. Over a period of several days, cumulative net flows reached approximately -$567.5 million.

While these outflows do not indicate systemic stress, they serve as a watchpoint for traders closely monitoring market sentiment. Continued monitoring of ETF flows alongside liquidity indicators will be essential in assessing Bitcoin’s near-term outlook.

The Path Ahead

Traders are now focusing on real-time market gauges as more immediate indicators of potential shifts in Bitcoin’s market conditions. The MOVE Index and credit spreads will provide vital insight into any forthcoming changes in the cryptocurrency landscape. Particularly, tracking ETF inflows and outflows will be key to understanding the fluctuations in Bitcoin’s liquidity.

As financial conditions remain stable, it is crucial for investors and traders to stay alert for any signs that might signal a shift in the market dynamics, especially as the environment evolves.