Ripple CEO Predicts Record High in 2026 Amid Clarity Act Uncertainty

Ripple CEO Brad Garlinghouse recently expressed optimism about the future of the cryptocurrency market. Speaking at the World Economic Forum in Davos, he forecasted new all-time highs for crypto within the next 12 months. This bullish outlook is attributed to potential regulatory changes, particularly in the United States. However, uncertainty surrounding the Clarity Act complicates the landscape.

Predictions for 2026

Garlinghouse stated during an interview with CNBC that he predicts crypto markets will reach record levels by 2026. He emphasized the significance of new US legislation regulating digital assets. “I’m very bullish, and yes, I’ll go on record as saying I think we’ll see an all-time high,” he mentioned, highlighting the transition of the US from a regulatory stance against crypto to one that supports the industry.

Impact of Legislation on the Crypto Market

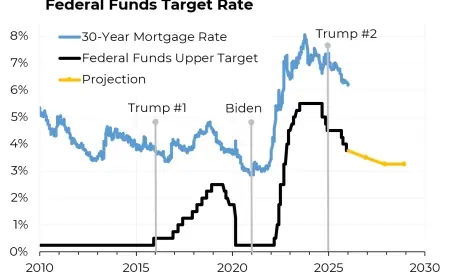

The year 2025 saw considerable progress for the crypto sector in the US. Under the administration of former President Donald Trump, the Securities and Exchange Commission (SEC) moderated its legal actions against leading crypto firms, including Ripple, Coinbase, and Binance. A significant advancement came with the Genius Act, which formalized the parameters for issuing dollar-pegged stablecoins.

- The Genius Act establishes guidelines for businesses issuing stablecoins.

- Companies like Robinhood and Bank of America are considering launching stablecoins.

- Ripple introduced its own stablecoin, RLUSD, in 2024, worth $1.4 billion per CoinGecko.

Garlinghouse noted that the interest from Wall Street signals a “massive sea change,” adding that he believes this is not fully reflected in the current crypto market prices.

The Clarity Act and Its Implications

Despite the positive developments, the industry is currently anxious about the Clarity Act. This legislation is crucial as it determines which regulatory body will oversee cryptocurrencies. The latest draft classifies all cryptocurrencies as securities, placing them under SEC jurisdiction unless they can demonstrate sufficient decentralization.

On January 14, Coinbase withdrew its support for this draft, which raised concerns about the bill’s future. Brian Armstrong, CEO of Coinbase, expressed that a poorly constructed bill would be worse than no legislation at all. In contrast, Garlinghouse remained optimistic about the Senate Banking Committee’s advancements and emphasized the importance of regulatory clarity.

Looking Ahead

As the cryptocurrency industry navigates these uncertain times, the potential for regulatory support remains promising. The ability to achieve clarity on regulations could greatly enhance confidence in the market. Garlinghouse’s predictions highlight a hopeful perspective that, if actualized, could lead the crypto landscape to new heights by 2026.

For more updates on cryptocurrency trends, stay connected with Filmogaz.com.