Suncor Stock Forecast: Projecting Its Value in 5 Years

Suncor Energy (TSX: SU) has shown impressive resilience and growth over the past year, making it a standout in the Canadian energy sector. While the overall performance of the oil and gas industry has been underwhelming, Suncor’s stock surged by 24%, and 28% on a total return basis, significantly exceeding the S&P/TSX Energy sub-index’s growth of 17%.

Suncor’s Recent Performance

The company’s strong performance can be attributed to effective management and strategic decisions that distinguish it from its counterparts. In contrast, while the TSX gained a modest amount, Suncor emerged as a notable exception.

Recent Earnings Results

Suncor’s recent earnings results reflect its strong operational performance. The following figures were reported in the latest quarterly release:

- Net Earnings: $1.6 billion

- Adjusted Operating Earnings: $1.79 billion

- Cash from Operations: $3.78 billion

- Earnings Per Share (EPS): $1.34

Although some of these numbers were lower compared to the previous year, they displayed improvement on a quarter-over-quarter basis. Notably, the EPS increased by 44% from the previous quarter, indicating robust growth potential.

Future Earnings Potential

The key question is whether Suncor can maintain its exceptional results moving forward. Analyzing both the short-term and long-term potential is crucial.

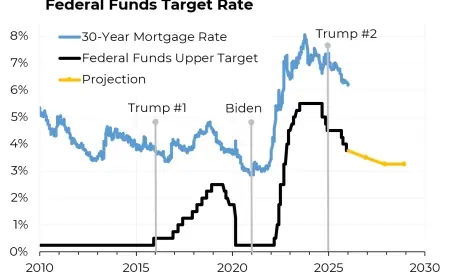

In the short term, oil prices are experiencing an upward trend. If Suncor maintains its operational strategy from Q3, it is expected to report strong growth in the upcoming quarters. While forecasting the Q4 results presents challenges due to fluctuating oil prices, the outlook for Suncor remains generally positive.

The long-term view is equally optimistic. Management’s disciplined approach underscores their commitment to fiscal responsibility. During the market rally in 2022, Suncor prioritized debt reduction over risky high-stake investments or special dividends, a strategy that positions the company for sustained profitability.

Strategic Diversification

Suncor’s diverse operational structure also supports its positive financial outlook. The company is not solely focused on exploration and production; it also engages in refining, natural gas, and retail operations. This diversification mitigates risks and allows Suncor to capitalise on various market conditions.

For instance, Suncor’s refineries can be profitable even amid lower oil prices due to advantageous pricing strategies. This capacity for adaptability further solidifies Suncor’s earning potential and aligns with their strategy for future growth.

Conclusion

Looking ahead, Suncor Energy is well-positioned to continue its upward trajectory. The combination of sound management, diverse operations, and a disciplined financial strategy strengthens expectations for the next five years. Stakeholders can remain optimistic about Suncor’s future, especially given its robust performance in a challenging industry landscape.