U.S. Stocks Stall Amid Surging Gold Prices

The U.S. stock market is experiencing a moment of stagnation as mixed earnings reports weigh heavily on investor sentiment. Notably, gold prices have surged, drawing attention from market analysts and investors alike.

U.S. Stocks Stall Amid Surging Gold Prices

On Thursday, the S&P 500 showed minimal movement, increasing by less than 0.1%. The index is nearing its all-time high set just days earlier. The Dow Jones Industrial Average, on the other hand, gained 162 points, or 0.3%, at 9:35 a.m. Eastern time. In contrast, the Nasdaq composite took a hit, falling by 0.6%.

Profit Reports Affect Market Dynamics

- Microsoft reported stronger-than-expected profits but saw its stock fall 10.4%. Concerns over investment spending and growth in its Azure cloud business influenced this decline.

- Meta Platforms rallied impressively, climbing 8.6% after exceeding profit expectations, despite ongoing investments in artificial intelligence.

- Tesla faced mixed reactions, swinging between gains and losses following its profit report that, while better than expected, was significantly lower than last year’s results.

- IBM saw a gain of 7.1% after surpassing analysts’ revenue and profit forecasts.

- Southwest Airlines increased by 9.7%, buoyed by a strong earnings forecast for 2026 despite a drop in quarterly profits.

- ServiceNow dropped 9.2% after announcing stronger-than-expected profits but struggling stock performance since summer.

Gold Prices Make Headlines

In the commodity market, gold prices have surged another 4.5% to reach $5,579.00 per ounce, marking a significant increase from earlier this week when it first topped $5,000. So far this year, gold has risen over 25% and has roughly doubled in value over the last 12 months.

This price increase reflects investor preferences for safer assets amid growing global risks. Concerns over high valuations in the U.S. stock market, political instability, tariffs, and significant government debts are contributing to gold’s appeal.

U.S. Dollar and Treasury Yields

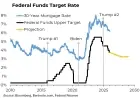

The U.S. dollar has depreciated against several currencies, including the euro and the British pound. In the bond market, the yield on the 10-year Treasury remained stable at 4.26%.

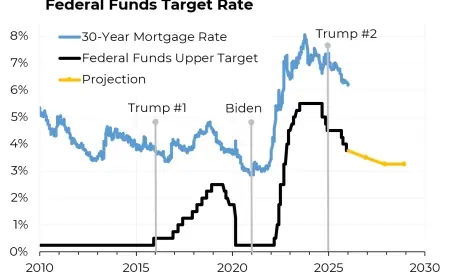

Recent actions from the Federal Reserve also impact market dynamics. Following three rate cuts at the end of 2025 aimed at stabilizing the job market, the Fed has decided to pause further reductions, maintaining a focus on inflation that exceeds the 2% target.

Global Market Response

Internationally, stock markets experienced upward momentum. Many indexes across Europe and Asia, particularly South Korea’s Kospi, climbed by around 1%, aided by favourable performances from major companies like chipmaker SK Hynix.

Overall, while U.S. equities remain near their peaks, the impressive gains in precious metals like gold and the complex dynamics of earnings reports highlight a cautious atmosphere in financial markets.