Trump’s Threat Drives Gold Prices Higher

Gold prices have seen a notable increase, primarily influenced by recent developments in the United States that are impacting investor sentiment. On Wednesday, the price of gold reached a record high, briefly hitting $5,602 (AU$7,901) per ounce before stabilizing at $5,542 an ounce. This surge follows a previous milestone where gold surpassed the $5,000 mark (AU$7,219) just a day earlier.

Market Reactions to Geopolitical Tensions

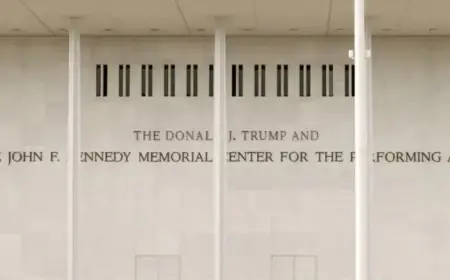

The considerable rise in gold prices can be attributed to ongoing geopolitical tensions. Notably, reports indicated that President Trump might consider new military strikes against Iran, escalating concerns among investors. Following unsuccessful preliminary discussions between the U.S. and Iran over nuclear issues, Trump warned that time is running out for a resolution.

Trump’s Statement on Iran

In a message posted on Truth Social, Trump emphasized the need for a fair deal with Iran. He referred to previous military actions, stating, “As I told Iran once before, MAKE A DEAL! They didn’t, and there was ‘Operation Midnight Hammer,’ a major destruction of Iran. The next attack will be far worse! Don’t make that happen again.”

Investment Trends and Federal Reserve Decisions

Gold gained momentum throughout the trading session, especially after the U.S. Federal Reserve announced it would maintain the official cash rate. Concurrently, the U.S. dollar fell to its lowest level in four years, further increasing the appeal of gold as a safe haven asset.

Long-Term Investment Views

- GlobalX ETFs strategist Justin Lin commented on the similarities between current market conditions and those of the 1970s.

- During that decade, gold prices soared from $35 (AU$50) to $800 (AU$1,128) per ounce.

- Lin suggested that today’s market is characterized by geopolitical uncertainties and dwindling confidence in the stability of currencies.

However, he noted that inflationary pressures today are less volatile than in previous decades, primarily due to the absence of significant oil-price shocks. This environment appears to be driving a structural shift in the global order, increasing the demand for asset diversification.

Conclusion

The current surge in gold prices demonstrates how external factors, particularly geopolitical tensions, can significantly influence market dynamics. As investors navigate this landscape, gold remains a critical component of their diversification strategies.