Federal Reserve Maintains Interest Rates Amid Trump Pressure

The Federal Reserve has opted to maintain its current interest rates, leaving them at approximately 3.6%. This decision comes after three cuts last year, indicating a cautious approach amid economic fluctuations. The Fed’s announcement suggests that the job market has shown some signs of stabilization, and it describes economic growth as “solid,” a noticeable improvement over last month’s assessment of “modest.”

Interest Rates and Inflation Outlook

While economic indicators remain optimistic, Fed officials express concerns regarding inflation, which currently sits at 2.8%. This figure is slightly elevated compared to the previous year and remains above the Fed’s target of 2%. Although some policymakers anticipate future rate cuts, many are awaiting clearer signs that inflation is decreasing.

- Current interest rate: 3.6%

- Inflation rate: 2.8%

- Previous rate cuts: Three reductions last year

Dissent Within the Federal Reserve

Notably, two members of the Federal Reserve’s board, Governors Stephen Miran and Christopher Waller, opposed the decision to maintain rates. Miran, appointed by President Donald Trump, has a history of advocating for sharper cuts. Waller is under consideration for a potential role as the next Fed Chair as Jerome Powell’s term approaches its conclusion in May.

Political Pressures on the Federal Reserve

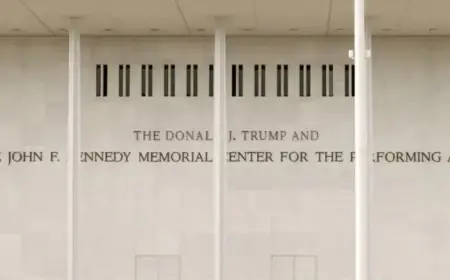

The Fed’s decision to keep rates steady may provoke further criticism from the Trump administration, which has been vocal about its dissatisfaction regarding rate adjustments. Trump has pushed for more aggressive cuts to stimulate the economy, often targeting Powell’s governance. In recent statements, Powell emphasized the importance of the Federal Reserve’s independence from political influence, arguing that monetary policy should prioritize the public’s interest over political gains.

Impact of Trade Policies

The Federal Reserve is also navigating the complexities introduced by the current administration’s trade policies, particularly tariffs. Powell noted in a recent press conference that the effects of these tariffs have likely been absorbed by inflation rates. He expects a reduction in these inflationary pressures, provided no new tariff increases occur.

Future Projections and Economic Indicators

Despite the current stance, many economists predict the Fed will implement rate cuts later this year, potentially in June. A significant factor for the Fed remains the economic outlook and consumer sentiment, which currently shows signs of pessimism. The Conference Board’s consumer confidence index recently dropped to an 11-year low, raising concerns that consumer spending may be adversely impacted.

- Expected future cuts: Potentially in June

- Consumer confidence: Dropped to an 11-year low

Overall, the Federal Reserve continues to face a delicate balance of maintaining economic stability while responding to pressure from political entities. As the year progresses, the central bank’s decisions will play a critical role in shaping the economic landscape, particularly concerning interest rates and inflation management.