Tesla Faces Second Consecutive Year of Decline

Tesla is experiencing its second consecutive year of declining revenue and profits, adding complexity to CEO Elon Musk’s ambitious vision of transforming the company into a leader in AI and robotics. Despite these setbacks, the global electric vehicle (EV) market is continuing to grow.

Tesla’s Financial Performance in 2025

In the fourth quarter of 2025, Tesla reported a net income of $840 million on $24.9 billion in revenue. This reflects a 3% decrease in revenue and a significant 61% drop in net profits compared to the same period in 2024, where the company had a net income of $2.3 billion on $25.7 billion in revenue.

For the full year of 2025, Tesla’s net income stood at $3.8 billion, with total revenue of $94.8 billion. This represents a 3% decline compared to the previous year.

Wall Street Expectations

Despite the drops in revenue and profits, Tesla outperformed Wall Street expectations. Analysts had predicted the company would report $24.79 billion in revenue according to estimates from LSEG.

Tesla’s Sales Challenges

In 2025, Tesla sold approximately 1.6 million vehicles, marking an 8.5% decrease year over year. Notably, customer deliveries fell by 15.6% in the fourth quarter as consumers rushed to purchase vehicles in the third quarter to take advantage of ending federal tax credits.

- Global EV sales rose by 20% in 2025.

- BYD, a Chinese automaker, surpassed Tesla as the world’s best-selling EV company, with 2.26 million vehicles sold.

Market Trends and Predictions

While the EV market is expanding, analysts anticipate that growth may slow in 2026 due to a decline in the Chinese market and reduced subsidies. Policy changes and economic factors are expected to contribute to this slowdown.

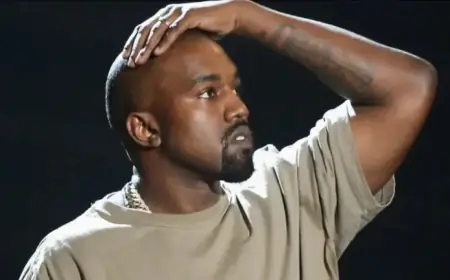

Challenges Faced by Tesla

The revenue decline is largely attributed to Tesla’s aging vehicle lineup and increasing competition from traditional automakers in the US, Europe, and China. Moreover, Elon Musk’s controversial political activities may have adversely impacted Tesla’s sales, reportedly costing the company over a million vehicle sales.

Musk has acknowledged the challenging environment, indicating that the company is likely to face “a few rough quarters” due to expiring incentives and macroeconomic conditions.

Future Plans and Aspirations

Despite current challenges, Musk remains optimistic about Tesla’s future. He believes the company’s AI initiatives, which include robotaxis and humanoid robots, will eventually lead to recovery and growth. Musk previously projected that by the end of 2025, 50% of the US population would have access to Tesla’s robotaxis—an estimation regarded as overly ambitious given current limitations.

In addition to these plans, Musk recently secured shareholder approval for a substantial new pay package. This agreement could position him to become the world’s first trillionaire if he meets several ambitious targets, including the production of one million robots and one million robotaxis.