S&P 500 Surpasses 7,000, Driven by Unexpected Stock Leaders

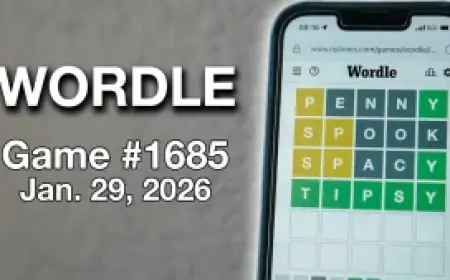

In a historic milestone, the S&P 500 index has surpassed the impressive mark of 7,000. This level was reached for the first time on Wednesday, January 28, 2026. The climb to this threshold underscores an extraordinary rally in U.S. large-cap stocks.

S&P 500 Surge Drives Market Optimism

The recent surge reflects a significant shift in market dynamics. Analysts note that this achievement revitalizes investor confidence, marking a new era for Wall Street.

Key Factors Behind the Rally

Several unexpected stock leaders have propelled the index to this new height. Their contributions have reshaped market perceptions and strategies.

- Strong earnings reports from major companies

- Increased consumer spending driving corporate profits

- Low interest rates encouraging investments

The crossing of the 7,000 mark signifies not only a numerical achievement but also a testament to the resilience and potential of U.S. equities.

Investor Reactions and Market Implications

Market analysts are watching closely as this milestone may indicate broader economic trends. The achievement comes amid discussions about potential volatility and significant market corrections.

With the S&P 500 surpassing 7,000, investors are encouraged to reassess their portfolios and strategies moving forward. This milestone offers both challenges and opportunities in an ever-evolving financial landscape.

For more insights and updates on stock market trends, visit Filmogaz.com.