Trump Sparks Exodus from US Dollar

The recent actions and statements by U.S. President Donald Trump have sparked significant shifts in financial markets. The U.S. dollar has faced aggressive selling, reaching multi-year lows. This decline has come amid record high performances on Wall Street.

Impacts of Trump’s Comments on the Dollar

President Trump appeared indifferent to the dollar’s decline during a press conference, stating, “Dollar’s doing great.” This remark came as the dollar experienced its largest three-day drop since April, raising concerns among investors.

- The euro surpassed $1.20 for the first time since 2021.

- The Australian dollar hit a three-year high, trading above 70 cents.

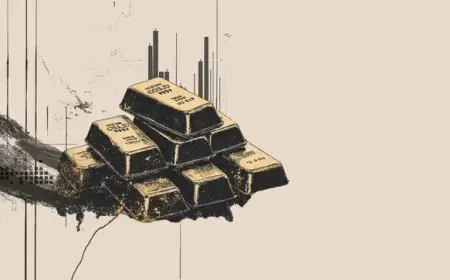

- Gold reached a record price of $5,188.95 per ounce.

- U.S. crude oil prices exceeded the 200-day moving average, hitting $62.54 per barrel.

- Bitcoin remains below $90,000, missing out on the overall rally.

Market Trends and Investor Sentiment

Currency market participants are always looking for trends. Insights from Steve Englander, head of global G10 currency research at Standard Chartered, reveal that Trump’s comments embolden U.S. dollar sellers. This results in a more pronounced decline for the dollar.

Last week, the New York Federal Reserve indicated a willingness to allow the yen to appreciate. This has contributed to the dollar’s decline, which has already fallen more than 9% in 2025, marking its largest decrease since 2017. Factors include Trump’s controversial foreign policy and his criticism of the Federal Reserve’s independence.

Stock Market Reactions

While the dollar struggled, Wall Street showed resilience. The S&P 500 climbed 0.4%, reaching a record closing high. However, health insurers faced declines due to proposals for limited increases in government payouts to insurers.

- Health insurers experienced significant market losses.

- Asian markets reflected a mixed response, with Australian shares gaining and Japan’s Nikkei declining by 0.7%.

- South Korea’s KOSPI rose by 1.7%, achieving a record high.

The current financial landscape showcases the volatile interplay between political statements and market responses. As investors navigate these changes, the future of the U.S. dollar remains uncertain amid ongoing economic developments.