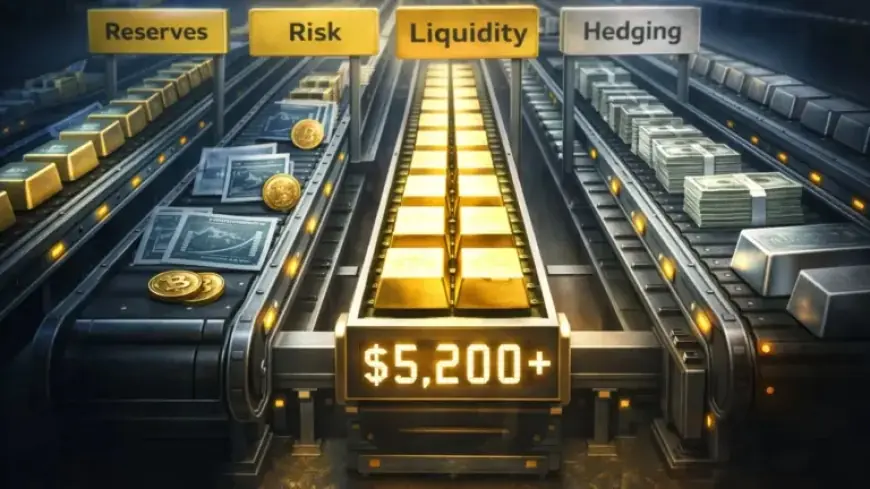

Gold Surges Past $5,000, Reflecting Global Market Structural Shifts

Recent developments in the global market have caused substantial fluctuations in gold prices, with the precious metal now exceeding $5,000 per ounce. This surge reflects significant structural shifts in the economy and investment landscape.

Gold Price Surge Highlights Market Changes

As investors navigate an evolving market, the rising price of gold has become a focal point. This increase can be attributed to several factors impacting supply and demand.

Key Factors Driving Gold Pricing

- Inflation Concerns: As inflation rises, gold remains a safe haven for preserving wealth.

- Geopolitical Tensions: Political unrest in various regions has led investors to seek stability in precious metals.

- Currency Fluctuations: The value of major currencies, particularly the US dollar, directly influences gold prices.

Market Implications of Surging Gold Prices

The surge past $5,000 signifies a transformative period in the commodities market. Investors are reevaluating their portfolios in light of these price changes.

- Increased Investment in Precious Metals: More investors are turning to gold as a protective asset.

- Shift in Mining Interests: Higher prices may stimulate investment in mining operations globally.

- Changes in Consumer Buying Patterns: Retail demand for gold jewelry and bullion is likely to rise.

Conclusion

Gold’s recent price surge underscores a pivotal moment marked by economic changes and market instability. As these dynamics unfold, both institutional and retail investors must stay informed through quality analysis and reporting.