Bank of Canada Maintains 2.25% Rate; CUSMA Review Poses Significant Risk

The Bank of Canada has decided to maintain its key interest rate at 2.25%. This marks the second consecutive meeting where the rate remains unchanged. The decision comes amidst significant economic uncertainties, particularly relating to trade negotiations with the United States and Mexico under the Canada-United States-Mexico Agreement (CUSMA).

Economic Outlook Amid Trade Risks

During a recent news conference in Ottawa, Bank of Canada Governor Tiff Macklem emphasized that the economic forecast has not changed significantly since October. However, he did note an increase in unpredictability around future economic conditions.

- U.S. trade policy remains erratic.

- Geopolitical tensions are heightened.

- The review of CUSMA could introduce significant economic risks.

Impact of CUSMA Negotiations

Macklem remarked that the era of open trade with the U.S. appears to be coming to an end. The review of CUSMA is a crucial element of economic uncertainty that could affect Canada’s outlook significantly. “We need to get on and adjust to that,” he said.

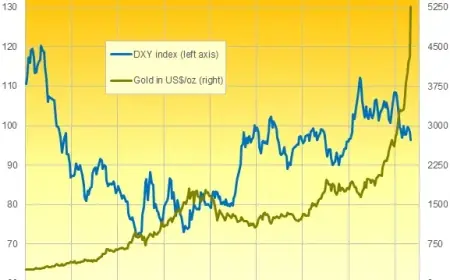

Additionally, he pointed out that while Canada is working to diversify its trade, the impacts of U.S. tariffs create more friction than benefits. The central bank’s economic projections assume that U.S. tariffs will remain, which highlights the importance of how the CUSMA negotiations unfold.

Federal Reserve Independence

Heightened economic uncertainty is also arising from threats to the independence of the U.S. Federal Reserve. Macklem expressed his support for Fed Chair Jerome Powell, who has faced pressure from President Trump regarding interest rate cuts. “A loss of independence for the Fed would affect us all, especially Canada,” Macklem stated.

Growth Projections and Employment Trends

Joseph Brusuelas, the chief economist at RSM, does not anticipate any changes to interest rates in the current year. He noted that the upcoming CUSMA review could create tensions that might necessitate a policy shift from the central bank.

- Modest GDP growth is expected at 1.1% in 2026 and 1.5% in 2027.

- Inflation is projected to remain near the 2% target.

Employment rates have increased recently, although the unemployment rate remains elevated at 6.8%. Moreover, businesses appear cautious about future hiring plans, as indicated by the recent Business Outlook Survey from the Bank of Canada.

Conclusion

In summary, the Bank of Canada’s interest rate decision reflects current economic conditions marked by trade uncertainties. The central bank maintains its position, but remains prepared to adjust rates based on future developments, particularly concerning the CUSMA negotiations. As economic conditions evolve, stakeholders will closely monitor both domestic indicators and international trade relations.