The Fed and Bank of Canada Await Major Earnings Reports Today

Today’s financial landscape is marked by significant announcements from major central banks and key earnings reports from influential companies. Investors are keenly awaiting outcomes that may shape market trends.

The Fed and Bank of Canada Await Major Earnings Reports Today

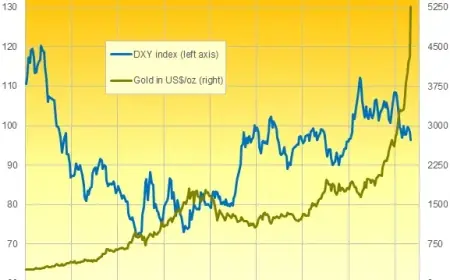

As of this morning, gold prices have experienced notable movement, initially surging to $5,311 before stabilizing at around $5,275, reflecting a daily increase of $86, or 1.9%. Meanwhile, S&P 500 futures are up by 0.2%, and the US dollar has regained some strength following a recent decline.

Bank of Canada’s Decision

First on the agenda is the Bank of Canada’s scheduled announcement at 9:45 AM ET. The market anticipates no changes to the current overnight rate of 2.25%. However, there is uncertainty regarding future movements, with a 25% probability of a rate cut in the coming months, juxtaposed with a 30% likelihood of an increase later this year.

Economic Indicators

The economic backdrop presents mixed signals, as various inflation metrics indicate divergent trends. Additionally, recent job statistics have been volatile, and the housing market continues to pose challenges.

Federal Reserve Meeting

The Federal Open Market Committee (FOMC) convenes at 2 PM ET today. While no rate changes are expected, speculation surrounds potential dissent regarding a 50 basis point cut from Miran, who will participate in his final meeting. Currently, the Fed funds futures curve suggests a cumulative easing of 48 basis points this year.

Corporate Earnings Reports

Following the central bank meetings, investors will turn their attention to earnings reports from three prominent companies: Microsoft (MSFT), Meta Platforms (META), and Tesla (TSLA). All three stocks are slightly up in pre-market trading, with expectations for significant post-hour movements. Recent trends show these stocks have rebounded after a challenging start to the year.

- MSFT: Expected move of 4%.

- META: Expected move of 6%.

- TSLA: Expected move of 8%.

Additional earnings scheduled for after the market closes include reports from IBM, Whirlpool, United Rentals, and Waste Management. Analysts will be monitoring these figures closely for insights into each company’s performance amid current market conditions.

As the day unfolds, both central bank decisions and corporate earnings will be pivotal in influencing market sentiment and direction.