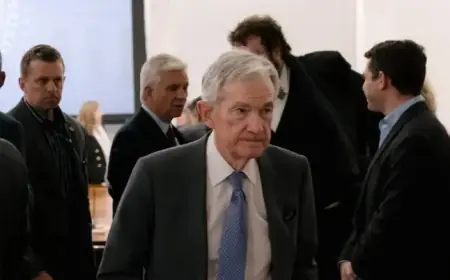

Powell Resists White House Rate Pressure at Key Fed Meeting

The Federal Reserve is set to maintain interest rates during its upcoming meeting, amid notable scrutiny and pressure from the White House. This meeting, scheduled for Wednesday, is laden with tension due to various external factors impacting the central bank’s independence.

Jerome Powell’s Stance Against Pressure

Federal Reserve Chairman Jerome Powell is currently facing a criminal investigation linked to a complaint by Jeanine Pirro, the U.S. Attorney for the District of Columbia. This inquiry has prompted Powell to allege that the White House is attempting to influence Fed policies, specifically regarding interest rate cuts favored by President Donald Trump.

Significance of the Meeting

The upcoming Fed meeting comes at a critical time. Powell’s term as chair concludes in May, and Trump is reportedly narrowing down a list of potential successors. As policymakers evaluate the economic landscape, maintaining the Fed’s independence is paramount.

Current Economic Conditions

Interest rates are not expected to change, but the meeting is under the spotlight due to ongoing political drama. The current condition of the labor market has shown signs of cooling, with recent job statistics making headlines:

- In October, the labor market contracted by 173,000 jobs.

- November saw an addition of 56,000 jobs.

- December recorded another 50,000 jobs added.

Despite low hiring rates, the unemployment rate fell to 4.4% in December from 4.5% the month prior. Experts have noted minimal layoff activity amidst these changes.

Inflation Trends

Inflation remains a concern as it stands above the Fed’s 2% target. Although it decreased from 3% in September to 2.7% in November and held steady in December, economists warn that these numbers may not fully reflect the economic reality due to data collection issues stemming from the government shutdown.

Political and Legal Drama

The tension between the White House and the Federal Reserve hasn’t gone unnoticed. On January 11, Powell disclosed that the Fed had received grand jury subpoenas, hinting at a potential criminal indictment, which escalated the long-standing conflict with the Trump administration.

| Event | Date | Details |

|---|---|---|

| Job Market Contraction | October | Loss of 173,000 jobs |

| Job Additions | November | 56,000 jobs added |

| Job Additions | December | 50,000 jobs added |

| Unemployment Rate | December | Decreased to 4.4% |

| Inflation Rate | December | Held steady at 2.7% |

This situation highlights ongoing discussions about the boundaries of presidential authority over the Federal Reserve, especially in light of a case involving the potential firing of Fed Governor Lisa Cook. The Supreme Court heard arguments earlier this month, where justices appeared skeptical of Trump’s justifications for his actions.

Conclusion

As the Federal Reserve prepares to announce its decision on interest rates, the intersection of economic policy and political maneuvering will be closely monitored. Investors are particularly interested in Powell’s statements regarding future interest rate cuts amidst the backdrop of significant legal and political challenges.