Sterling Rises Against Dollar for Fourth Straight Day

The British pound has risen against the U.S. dollar for the fourth consecutive day, demonstrating its strength amid various economic factors. On January 27, the pound reached $1.3696, marking a minor increase of 0.12% and approaching a four-month peak.

Economic Factors Influencing Sterling’s Rise

Retail inflation data released recently has contributed to the pound’s upward momentum. The British Retail Consortium reported that prices at major retailers surged at the fastest rate in nearly two years throughout January.

- Current Exchange Rate: £1 = $1.3696

- Inflation Rate: Highest increase in almost two years

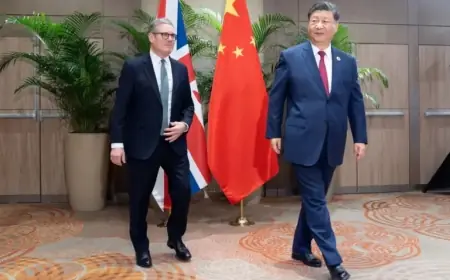

- Political Tension: Labour Party blocking Andy Burnham’s return to parliament

U.S. Dollar Facing Challenges

The dollar has faced pressure from geopolitical tensions and ongoing tariff uncertainties. These factors have generated a renewed wave of selling among traders, who are also wary of potential currency interventions by U.S. and Japanese authorities.

Market Reactions and Predictions

While the pound has strengthened, political uncertainties in the UK remain prevalent. The Labour Party’s internal conflicts raise concerns about political stability. Analysts suggest that the Bank of England may keep interest rates stable in their upcoming meeting.

Current market expectations indicate a possibility of one interest rate cut by mid-year and potentially another by December.

Conclusion: Outlook for Sterling

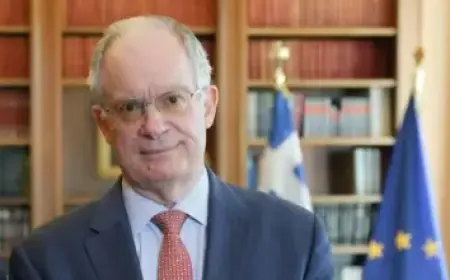

Nick Rees, head of macro research at Monex, remarks that traders should be vigilant regarding the UK’s political landscape. As political instability unfolds, there might be downside risks for the pound, particularly if the market’s focus shifts back to domestic issues.