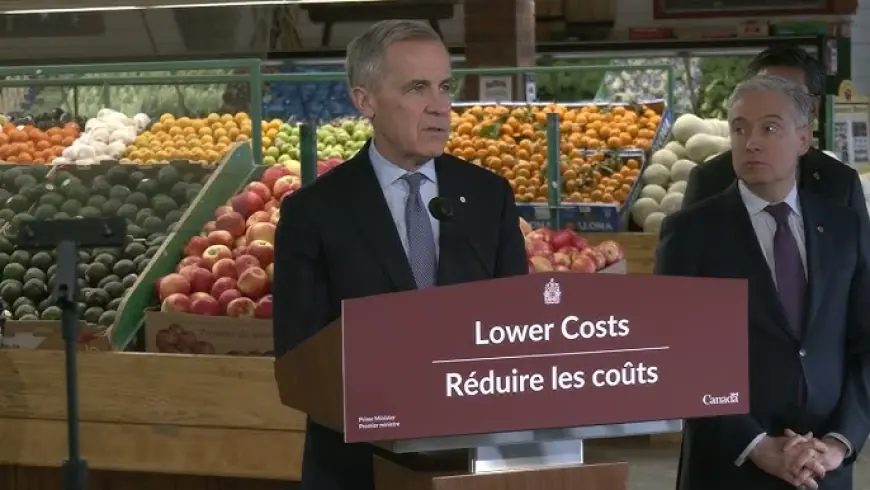

Canada Groceries and Essentials Benefit: New GST Credit Top-Up, Eligibility, and 2026 Payment Timeline

The canada groceries and essentials benefit is moving to the center of Canada’s affordability debate after Prime Minister Mark Carney unveiled a plan to boost support tied to the GST credit, including a proposed one-time top-up and a multi-year increase aimed at easing pressure on grocery bills and other basics.

Announced Monday, January 26, 2026 ET, the measures are framed as targeted help for low- and modest-income households as food costs remain a dominant cost-of-living issue.

Carney’s grocery plan reshapes the GST credit conversation

Carney’s government says it is introducing the Canada Groceries and Essentials Benefit as a reworked version of what many Canadians know as the GST credit. The headline changes are a proposed increase of 25 percent to the benefit for five years beginning in July 2026, plus a one-time payment in 2026 described as being equal to half of the current benefit value for the year.

The government has also pointed to additional supports beyond direct payments, including funding intended for food-sector capital investments, help for small and medium-sized businesses, and expanded support for food banks and community food programs.

Some specifics have not been publicly clarified, including the full breakdown of how benefit amounts will vary across household types and income ranges under the new structure beyond broad examples shared in the announcement.

GST rebate eligibility and who qualifies for the benefit

For people searching terms like GST rebate eligibility, GST credit eligibility, or who qualifies for GST rebate, the key point is that qualification is anchored in the same general rules used for the existing GST and HST credit.

In general, eligibility depends on factors that include residency for tax purposes and family situation. Many recipients qualify by being at least 19 years old. If someone is under 19, they may still qualify if they have or had a spouse or common-law partner, or if they are or were a parent living with their child. You also typically need to be a resident of Canada for tax purposes around the time payments are issued.

The payments are meant for individuals and families with low and modest incomes, and the amount is calculated using adjusted family net income, marital status, and the number of eligible children registered in the system. Key terms have not been disclosed publicly about any potential new income thresholds or edge-case rules that could expand or narrow eligibility compared with the current approach.

One practical detail matters as much as any policy headline: you do not normally apply separately for the GST credit style benefit. The system generally works by assessing eligibility automatically when you file your income tax return.

When the GST credit and grocery rebate payments land in 2026

For Canadians tracking dates and searching new GST credit 2026 or GST rebate 2026, the regular quarterly payment schedule remains the backbone of the program. The Canada Revenue Agency lists four GST and HST credit payment dates in 2026: January 5, April 2, July 3, and October 5.

The timing also determines which tax return information is used. January and April payments are based on the adjusted family net income information from your 2024 tax return. July and October payments are based on your 2025 tax return, because the benefit year resets each July and runs through the following June.

This is also where the proposed grocery top-up fits. The government has said the one-time top-up would be paid in spring 2026, no later than June, and would be based on eligibility for the January 2026 GST credit payment. Recipients would not need to apply for the extra payment, but filing matters: people who have not filed their 2024 tax return are being urged to do so to ensure eligibility can be assessed. To receive the increased quarterly amounts starting in July 2026, taxpayers would need to file their 2025 return so the July recalculation can take place.

What this means for households, and the next step in Parliament

If the plan becomes law, the most direct impact would be felt by low- and modest-income families who already rely on quarterly credits to offset sales taxes and smooth out budgets. Parents with children, seniors on fixed incomes, and newcomers who qualify can also see real-world relief because even a few hundred dollars can cover several grocery trips, winter utility spikes, or back-to-school basics. Food banks and community programs may also experience secondary effects if households have more cash flow, even as demand patterns remain sensitive to rent and other costs.

For other Canadians, the practical effect is more about timing and expectations. People who do not qualify for the GST credit will not see direct payments, but they may still see broader ripple effects if the accompanying measures aimed at food supply and small business costs translate into steadier pricing over time.

The next verifiable milestone is legislative: enabling legislation for the one-time top-up and the five-year increase is expected to be tabled in the coming weeks, followed by parliamentary debate, votes, and Royal Assent before the spring payment can be issued.