Yen Confidence Crisis Threatens Japan PM Takaichi’s Election Strategy

The ongoing decline of the yen poses significant challenges for Japan as it approaches a crucial election. Prime Minister Sanae Takaichi’s strategy focuses on economic stimulus, which may influence her approach to managing the currency crisis.

Yen Confidence Crisis: Implications for Takaichi’s Election Strategy

With parliamentary elections looming, Takaichi’s government faces mounting pressure from the yen’s slide. Japan’s currency has weakened significantly, causing concerns about the nation’s financial stability. As of now, Japan’s government debt stands at a staggering 230% of Gross Domestic Product (GDP), the highest among developed economies.

Market Reactions and Currency Intervention

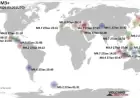

Traders have responded to the yen’s decline with increasing apprehension. Historical data suggests that market interventions might yield limited results, particularly given Japan’s fiscal challenges. The last intervention by Japanese authorities occurred in July 2024, and speculation rises that similar actions may be needed again.

- Expectations exist that if the dollar-yen exchange rate exceeds 160, the government may attempt intervention.

- Analysts like Toshinobu Chiba predict possible lows of 180 yen per dollar if Takaichi’s stimulus efforts succeed.

Currently, Japanese government bond yields have soared to record levels. Typically, higher yields would strengthen the currency. However, the usual correlation has dissipated as investor confidence wanes.

Fiscal Concerns and Election Strategy

Takaichi proposes suspending the consumption tax on food, which generates about 5 trillion yen annually. Yet, she has not outlined plans to address the resulting revenue shortfall. This tax suspension could exacerbate fears of a fiscal crisis and complicate Japan’s long-term financial health.

Investor Sentiment

The market is shifting, with concerns of a “Sell Japan” phenomenon impacting various asset classes. Stocks recently faced significant sell-offs, leading to increased anxiety as the yen approaches historic lows against the euro and Swiss franc.

On an unexpected note, the yen experienced a brief rally recently, strengthening against the dollar following signals from both the Bank of Japan and the U.S. Federal Reserve. This joint action has rarely been seen but may reflect a coordinated effort to support the yen amid its struggles.

Looking Ahead

The upcoming election is pivotal for Takaichi as she seeks to solidify her economic plans. The public’s perception of Japan’s financial stability could sway voter sentiment, making the management of both monetary and fiscal policies critical in the weeks ahead.

The yen’s fate remains uncertain, but with Takaichi aiming for economic revitalization, investors are keenly watching her next moves, while also grappling with Japan’s complex fiscal reality.