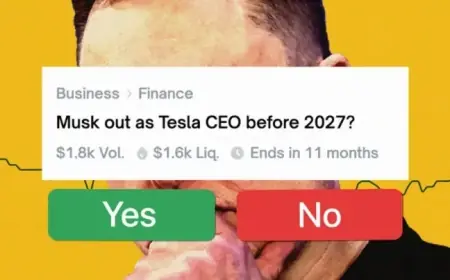

Trump’s JPMorgan Lawsuit Highlights Intensifying Wall Street Conflict

A recent lawsuit filed by former U.S. President Donald Trump against JPMorgan Chase has intensified the ongoing conflict between Wall Street and political forces. The $5 billion lawsuit alleges that JPMorgan and its CEO, Jamie Dimon, closed Trump’s accounts based on his political affiliations. This confrontation marks a pivotal moment in the relationship between large financial institutions and the political landscape.

Background of the Lawsuit

This legal action is perhaps Trump’s most direct challenge to the financial sector, accusing it of political discrimination. Trump claims that major banks have consistently worked to marginalize him and other conservative figures, a claim that JPMorgan denies. The bank stated that it does not terminate accounts for political or religious reasons.

Implications for Wall Street

The lawsuit highlights the unpredictable nature of the policy environment for big banks under the Trump administration. Financial institutions, which initially expected substantial benefits from Trump’s deregulation efforts, are now grappling with challenges that could tarnish their reputations. The lawsuit coincides with Trump’s proposal to cap credit card interest rates at 10%, which Dimon has labeled as an “economic disaster.”

Response from the Financial Industry

Many banks, including JPMorgan, are becoming increasingly cautious. Experts suggest that the financial sector could be reshaping its lobbying strategies in response to the potential for legal action and regulatory scrutiny. “The industry is losing as many battles as it wins, and this pressure is taking its toll,” stated Todd Baker, a senior fellow at Columbia University.

- Trump’s lawsuit total: $5 billion

- Key accusations: Political discrimination by banks

- Regulatory actions potentially beneficial for banks: Estimated capital relief of up to $200 billion

Wall Street’s Advocacy Efforts

In light of growing tensions, Wall Street banks have bolstered their advocacy efforts in Washington. The eight largest banks increased their lobbying expenditures by nearly 40%, amounting to $12 million in Q4 of 2025 compared to 2024. Their lobbying focuses on issues such as credit card fees and cryptocurrency regulations.

Future Outlook

Despite the current challenges, the banking sector remains optimistic about future regulatory changes that could enhance profitability. Many industry leaders express hope that easing regulatory burdens will create favorable conditions for growth. Investors also note that bank shares have performed well under the current administration, suggesting a level of financial resilience.

However, as Trump’s policies evolve, particularly as he addresses voter concerns about the cost of living, large banks may continue to face uncertainties that could reshape their operations. As the situation unfolds, it will be crucial for financial institutions to navigate this complex political and regulatory landscape.