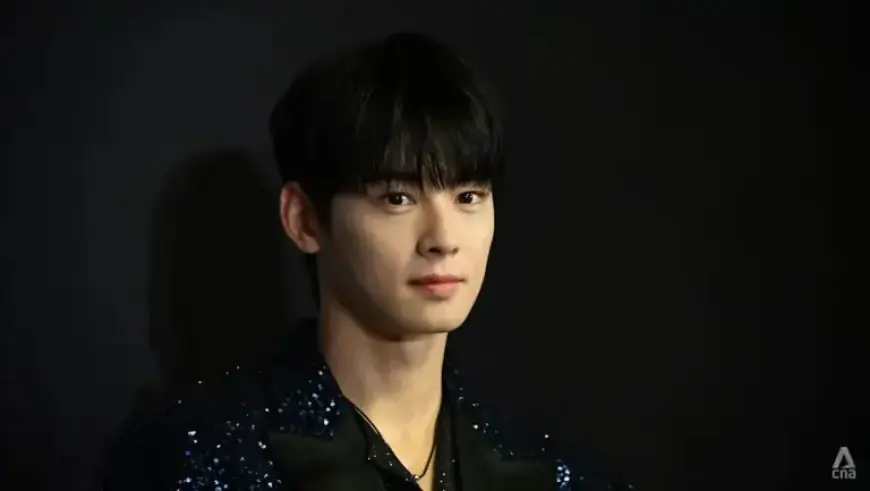

Cha Eun-woo Investigated for Alleged $13.6 Million Tax Evasion in South Korea

Cha Eun-woo, a prominent actor and member of the South Korean band Astro, is embroiled in a significant tax evasion investigation valued at approximately 20 billion won, equal to about $13.6 million. The inquiry is being conducted by South Korea’s National Tax Service (NTS).

Investigation Details

The investigation was initiated by the Seoul Regional Tax Office’s Investigation Division 4, which specializes in serious tax evasion cases. This intensive audit began in July 2025, shortly before Cha’s military enlistment.

Allegations of Tax Evasion

The center of the allegations is a “one-person agency” reportedly established by Cha Eun-woo’s mother. Despite being under the management of Fantagio, it is claimed that Cha’s earnings were funneled through this separate entity. This arrangement permitted the actor’s income to be divided among Fantagio, the agency created by his mother, and Cha himself.

- The purported agency failed to offer actual services.

- Tax authorities identified it as a “paper company” designed to decrease tax liabilities.

- The corporate tax rate is substantially lower than the individual income tax rate of 45% in South Korea.

Location and Operations of the Agency

The location of the company raised eyebrows. It was registered in a remote area of Ganghwa Island, which was deemed inappropriate for entertainment operations. Although various expenses were charged to the company, there was no evidence of any unique services being provided compared to those offered by Fantagio.

Consequences of the Investigation

As a result of these findings, both Cha and his mother were called in for questioning. The investigation concluded that the financial gains from the company ultimately benefited Cha himself. The tax amount owed was reported to be 20 billion won.

Impact on Fantagio

The repercussions also affected Fantagio, as it was discovered that the agency was involved in processing false tax invoices from Cha’s mother’s company. Subsequently, Fantagio faced an additional tax charge of 8.2 billion won, as determined by the Seoul Regional Tax Office in August 2025.

Response from Fantagio

On January 22, 2026, Fantagio issued a statement clarifying that the matter remains unresolved. They intend to articulate their position through legal channels and emphasized their commitment to cooperate with the ongoing investigations. Cha Eun-woo also pledged to fulfill his tax responsibilities diligently.

Current Status

Cha Eun-woo is presently fulfilling his military service, with an expected discharge date in January 2027. The investigation continues as authorities seek to clarify the intricate details surrounding the alleged tax evasion.