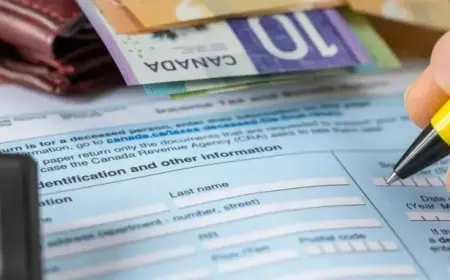

Asian Stocks Expected to Rise Following US Data; BOJ Actions in Focus

Asian stock markets are anticipated to rise following favorable US economic data and ongoing actions by the Bank of Japan (BOJ). The latest shifts in global investor sentiment indicate a growing preference for assets outside the United States.

Asian Markets on the Uptrend

Recent reports reveal that the MSCI Asia Pacific Index has recorded a 0.4% increase. This marks a significant rise, with emerging market stocks also reaching record highs. The impressive performance in Asia is attributed to various economic factors and changing market dynamics.

Impact of US Data

The positive reception of US data appears to have influenced investor confidence globally. Despite the strong showing in Asia, US equity-index futures suggested gains that were less pronounced than those observed in Asian markets.

Europe’s Market Outlook

In contrast, contracts for European shares indicated a slight downturn. This discrepancy highlights the varying responses across global markets influenced by economic indicators and geopolitical risks.

Geopolitical Influences and Precious Metals’ Surge

Investor caution persists amid geopolitical uncertainties, pushing many toward non-US assets. Meanwhile, precious metals have reached all-time highs, reflecting a shift in investment strategies.

- MSCI Asia Pacific Index: +0.4%

- Emerging market stocks: Record high

- US equity-index futures: Lesser gains compared to Asia

- European shares: Slight loss anticipated

The current trends in Asian stocks, influenced by US data and BOJ policies, suggest a continued upward momentum for the region’s markets. Investors remain vigilant as they navigate the intricacies of global economic conditions and geopolitical events.